Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

As a loan officer, you have a lot riding on your mortgage business. Here are some important lessons that you do not want to learn the hard way.

Mistake #1: You pay big money for lead generators

A lot of mortgage lenders pay for “lead systems” that fall flat. These guys will promise you new business, but they’re usually very time consuming and offer little to no results. The problem with most lead generators? They spit out leads that (a) aren’t interested in buying a home, (b) probably won’t qualify for a mortgage, or (c) are already taken by another lender.

As a loan officer, you have to invest in your business, but if you’re going to drop a couple grand on leads, then you should at the very least get connected with better prospects. You want to find clients that are looking to buy a home and are likely to qualify. Most importantly, these leads should be exclusive. You shouldn’t have to compete with other lenders for a single lead.

And the only thing worse than wasting money on crummy leads? Wasting your precious time! Your day is already packed with serving clients and managing your business, so you CANNOT afford to waste time chasing after people who aren’t even interested.

Mistake #2: You rely on realtors for referrals

Everyone wants to focus on the pretty picture: the picket fence, the two-car garage and the backyard where their kids will play. People looking for their dream home will seek out realtors first, because most prospects have no idea about the process of buying a home. Prospective borrowers don’t think about the financial realities of interest rates and getting approved for a mortgage.

For these reasons, realtors have WAY better access to leads than you do. You may’ve been told to network with realtors, buy them coffee, drop by open houses on the weekends, all in the hopes of getting referrals. But realtors don’t want your free coffee! Why would realtors hand you referrals when (a) they’ve already chosen their preferred lenders and (b) you have NOTHING to offer them in return?

So lenders AND realtors alike are pretty tired of this age-old industry shortcoming. Truth is, if you really want more referral business, you have to generate your OWN pre-approvals to bring to realtors. This solid leverage is crucial to boosting your realtor partnerships, so you can generate referral business for months and even years to come.

Mistake #3: You don’t catch leads in time

Yet another MAJOR problem with leads? If you don’t help them right away, someone else will.

Qualified borrowers are ready to buy a home, so you HAVE to connect with them as soon as they’re interested. But with trying to find leads AND book appointments all on your own…you’ll never be able to grab them before they slip away.

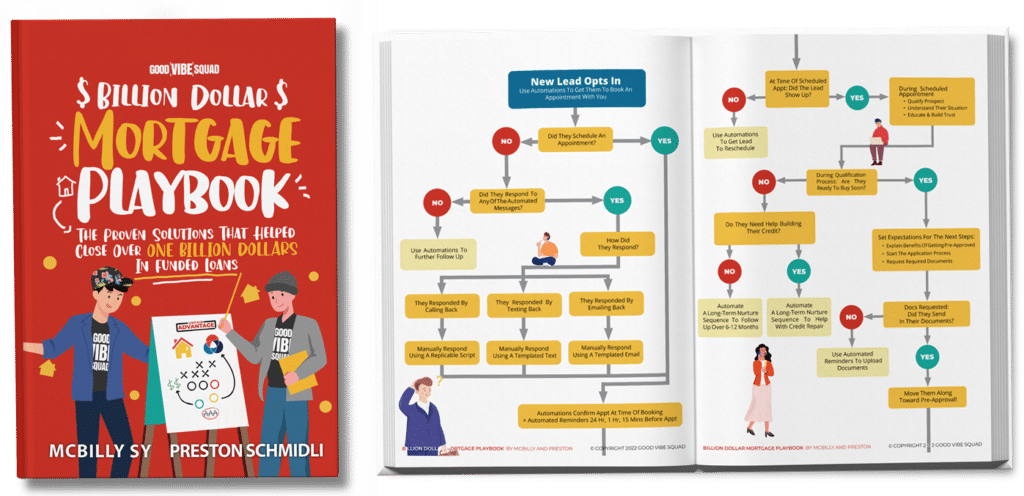

That’s why a lot of loan officers use automated systems to follow up with leads, and automations are definitely helpful! Unfortunately, you can’t automate everything.

When it comes to automated follow ups, the goal is to get clients on a phone call as fast as possible, so you can quickly build that relationship and start taking apps.

Another thing to keep in mind, you don’t want your automations to read like robo-texts. You need to use customized messages to build that trust before getting your clients on the phone.

In short, using automations to catch leads within that narrow time frame is important, but you don’t want to scare prospects away with creepy robo-texts. Just make sure you’re using the right kinds of automations that are personalized and effective.

Mistake #4: You try do-it-yourself marketing

In the mortgage industry, you have to market yourself. And while you’re probably an expert at originating loans, you’re not an expert at advertising.

A lot of lenders try Do-It-Yourself Marketing. They post ads on Facebook, try word of mouth, and even spend money on newspaper or radio advertisements. The sad truth? These DIY marketing tactics aren’t effective. And they’re definitely not sustainable when it comes to long term growth. There’s just not enough time in the day to manage a growing mortgage business while also doing your own marketing.

This is why a lot of lenders outsource their marketing. Still, it’s hard to find a marketing partner you can trust. Most marketing “gurus” out there don’t really care about you. They just want to cash your check.

When choosing a marketing solution for your mortgage business, keep an eye out for the marketing partners who are really in it for the long haul.

True partners value long term relationships. As opposed to the other guys who will just take your money and run, the solid marketing partners will go the distance for you and your mortgage business. So don’t fall prey to shady marketing gurus. Keep an eye out for marketing systems that come with a solid partner you can count on.

Mistake #5: You sign risky co-marketing agreements

You’re the main person in charge of your mortgage business. But even though you’re the one calling all the shots, it’s still easy to fall victim to outside influences. If you’re working out of a lending office, your coworkers probably give you A LOT of advice on how to “crush your goals” and become a “high roller.”

They tell you all the different ways you can invest in your business, like signing co-marketing agreements (that come with ZERO guarantees of a return on investment).

Look, partnerships are a must, but a true partnership means a win-win relationship. So read the fine print before signing, and NEVER enter a deal where someone has more leverage than you do.

All in all, the industry can get competitive, so maintain a healthy level of skepticism. Don’t get burned by people who don’t have your best interests at heart.

Mistake #6: You don’t maximize profits on past clients

The relationships you build with your clients run deep. So when rates change months or years down the road, why wouldn’t YOU be the first person to come to when your client wants to refinance?

The only thing holding you back from closing multiple deals on one client is knowing when and how to follow up on refinance opportunities.

Once you have that follow up system in place, then closing those refi’s will be a breeze, because these clients already have a great relationship with you!

The Takeaway? Congrats, now you know what mistakes to avoid!

You may be feeling a little lost on the RIGHT ways to grow your mortgage business. I get it. The path to success can be riddled with confusion and self doubt.

But it doesn’t have to be that way. If you want to find out about proven strategies to grow your mortgage business, book a FREE strategy call with us to learn more.