The only way any company can grow is by accruing leads, including mortgage lending companies. Lead generation is, quite possibly, the most important thing any business does, so it’s vital that companies develop strong lead generation strategies. However, most struggle with lead generation.

Usually, when people think about lead generation, they become overwhelmed with the idea of traditional marketing strategies like cold calling, direct mail, or newspaper ads. These methods can be incredibly time-consuming and exhausting to think about. Fortunately, you don’t have to resort to these today because stronger, easier methods have been created.

Let’s look more closely at mortgage leads and explore a few simple lead-generation strategies you can use to expand your business.

Key Takeaways

- Mortgage leads are potential customers interested in mortgages or refinancing, and generating them is crucial to growing your business.

- There are several ways to generate mortgage leads, including organic and paid search, referrals, content marketing, email marketing, Google My Business, social media marketing, your website, conversion rate optimization, PPC advertising, online review platforms, and networking.

- Buying mortgage leads is an option, but it may not be cost-effective, and you should consider factors such as lead quality, generation method, lead age, exclusivity, filtering options, and return policy before making a purchase.

- Effective lead generation can help you gain new clients and grow your business, so it’s important to create an effective lead generation strategy.

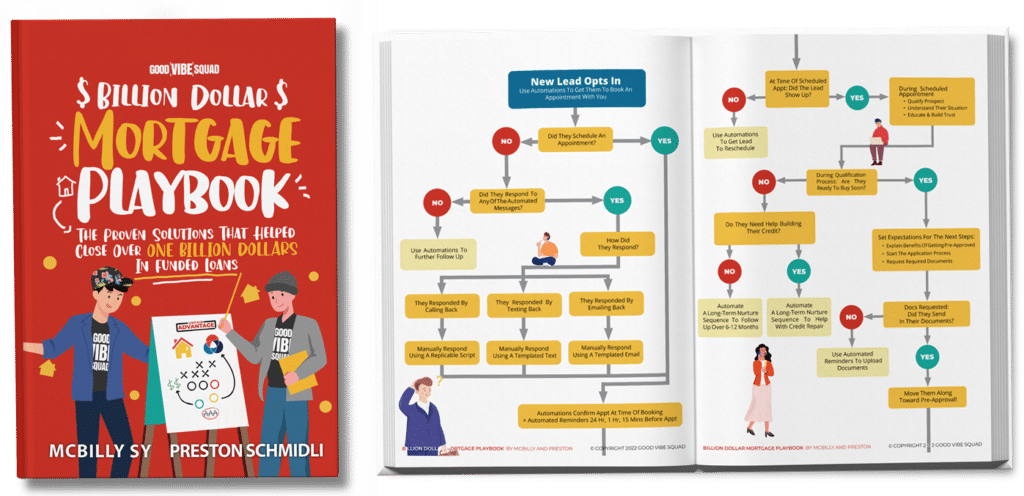

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

What is a mortgage lead?

You’ve probably seen mortgage leads mentioned all over the place if you’ve done your marketing research for mortgage loan officers, but what is it exactly?

To break it down, mortgage leads are leads that are specifically garnered for those working in the mortgage industry, like mortgage loan officers. “Lead” is the term for any person, group of people, or organization that shows interest in the products or services you offer. Once they become interested in a product or service, leads generally want to seek more information about the product.

For mortgage leads, once homebuyers become interested in a mortgage or a mortgage refinance, they are much more likely to seek out your business for further information and to become borrowers themselves.

How do you generate mortgage leads?

Mortgage lead generation is one of the most important things a mortgage loan officer can do. After all, without leads, you can’t grow your business or gain new clients.

Let’s look at a few ways you can generate these leads online for your company.

1. Organic vs. paid search

Search engine results and ranking high in them is a great way to promote your business to leads. These results are ranked in either organic searches – or searches gathered from unpaid rankings that rely heavily on SEO – or paid searches, where rankings are organized by how much a person or business paid for them.

With organic search traffic, leads can find your business among the related search engine results. With paid search traffic, leads find your business when they click on advertisements or sponsored listings that your company has paid for. Generally, you can get faster results with paid searches. However, organic searches are more efficient and cost-effective in the long run.

2. Referrals

Getting referrals is another good way to generate leads. Typically, the individuals you solicit referrals from are already happy with the services and products you have provided. These people can give good recommendations to their friends and family on behalf of your business. These referrals can be strong leads and are likely to work with you well.

When asking for a referral, make sure you are straightforward and personal but not pushy. Refer to work you and your client accomplished together to remind them of how strong your working relationship was and highlight specific instances. Additionally, even if you ask for a referral in person, try to send an email reminding your clients of your request.

3. Content marketing

With content marketing, you have a whole world of options – from text-based messages to audio clips or videos and images. Companies typically use these on blogs or social media pages to promote their company to a large audience because of how helpful it is in generating leads.

It’s very important to create current content for your target audience because it shows them that you are active in your own community and that you’re staying on top of any new trends in your field when others may not be.

Keep in mind that you need to do appropriate amounts of market research, be aware of the common objections, and know your audience demographics and educational background. If you don’t know who you’re creating for, you can’t make successful, lead-generating content.

4. Email marketing

One of the most cost-effective, easy-to-use marketing tools is email marketing. After all, it costs nothing to send an email, and there are few processes simpler than sending one.

Additionally, of more than 3.9 billion active email users, at least 44% will remember the brand that emailed them, even if they don’t open them. Unfortunately, while email is more cost- and time-efficient, about only 20-30% of them will actually open the message in the first place. This is at odds with the 90% of people who open direct mail, and 75% will remember the brand that mailed them.

5. Google My Business (Google Business Profile)

It can be a great advantage to have a Google Business Profile, formerly known as Google My Business (GMB) account. It allows you to track and control how your business appears in Google searches and what specific content people will see when looking up your company. GMB can also show reviews your business has, which is a great way to promote your reputation and show leads that you are a trustworthy business.

Further, you can list your business and GMB account online or in local business directories to broaden your lead pool.

6. Social media marketing

In today’s digital world, it is important to provide a digital presence for your business wherever possible, and this includes social media platforms like Facebook, Twitter, and LinkedIn. These platforms are a great place to share your written and video content as well as engage and interact with potential leads and existing clients. Having an active social media profile helps to gain high-quality leads, legitimize your business and services, and help promote active engagement.

7. Website

A quality website can be your most powerful tool when it comes to lead generation. A well-designed site containing optimized content can help ensure that borrowers looking for a mortgage lender in their area can find your business. Taking advantage of website forms and signups provides a powerful way to obtain new, qualified leads. You want to make sure that your website, along with quality content, also provides easy navigation and access to your contact information. In addition, you want to provide a clear and concise call to action on your web pages.

8. Conversion rate optimization (CRO)

Conversion rate optimization refers to analyzing and making changes to your website in order to maximize the leads that come in. Using the in-depth analysis that looks at things like usability, website copy, aesthetics, and conversion paths, you are able to make adjustments that can help increase your lead conversion rates. For example, if you currently have a website form that asks numerous mandatory questions of visitors before they can submit, you may be losing potential leads that do not have the time to commit to so many questions. By changing these to only include qualifying questions that reduce the commitment time, you may see an increase in qualified leads.

9. PPC advertising

Pay-per-click (PPC) advertising can be extremely effective for lead generation when done correctly. When it comes to PPC advertising, you have a few options. While most social media platforms offer this advertising method, the main PPC advertising is through Google Ads. This advertising method allows you to choose keywords and key phrases that you want to rank for and, when a person searches for those keywords, your ad will appear for a price. However, this price can be extremely high depending on the keywords you choose as the more popular a keyword is, the higher the price per click. You want to make sure that you narrow your search results in order to draw in qualifying leads that are likely to convert.

10. Online review platforms

In today’s digital world, online reviews can have a major impact on your lead generation and are a vital part of your digital marketing strategy. In fact, reports show that 93% of online users say reviews have an impact on their decision when it comes to choosing a company. Of those, 81% of potential customers use Google to evaluate local businesses by reading reviews. As we mentioned above, a Google Business Profile not only helps your website ranking but also provides quick access to Google reviews for your business.

11. Networking

As a loan officer or mortgage broker, you probably already know the benefits of networking with real estate agents and realtors for lead generation. But other networking partners can be just as important. For example, networking with a divorce lawyer can prove beneficial as many divorces require the sale of a property. Look for community networking events, such as with your local Chamber of Commerce, and become active. Offer to host a networking event where you speak on the trends in the mortgage industry or other valuable information that allows you to share your knowledge and meet new potential networking partners that can effectively boost your lead generation.

Can you buy mortgage leads?

When mortgage loan businesses look into generating leads, they may often consider whether or not buying leads is an option. The good news for these people is that you can buy mortgage leads. Unfortunately, this often isn’t a cost-effective venture. Buying a single mortgage lead can cost anywhere from $20 to $100 per lead, and this doesn’t include any of the cost accrued during the time you spend converting the lead into a borrower.

Things to consider before buying mortgage leads

If you are still tempted to buy mortgage leads, there are a few things you should consider when choosing which leads to purchase and if it is really worth the cost.

- Your budget: The first thing you must consider is how much you can afford to spend per lead and how many leads are you looking to acquire. Many lead companies require a minimum lead purchase amount, and this may be larger than your budget.

- Lead quality: Not all leads are created equal. Is there a qualifying process in place that filters out those not qualified or ready to convert?

- Lead generation: How is the lead company getting its leads? Are they coming from cold-calling or a qualifying landing page and requesting contact from a mortgage specialist?

- Lead age: In today’s digital world, consumers are looking for answers and responses at the touch of a button. While a mortgage lead may have been qualified last week, purchasing that lead now is likely to mean they have already found your competition. Look for fresh leads less than 24 hours old. While these will cost more, they are more likely to convert.

- Exclusivity: Are you the only mortgage business purchasing a particular lead or are they being sold to multiple loan officers? When purchasing a lead, you want that to be your lead without the risk of immediate competition.

- Can you filter the leads: When buying leads, does the lead company offer the ability to filter leads based on your customer persona?

- Return policy: There are times when a lead is missing significant information, such as a mailing address, or it may include false information. Does the lead company provide returns on leads that are not accurate?

Quality lead generation can help you boost your business

Quality mortgage lead generation is essential for the success of any mortgage business. Following these lead generation tips can help ensure that you create an effective lead generation strategy and that all your marketing efforts succeed in bringing in quality leads that are more likely to convert.

Our tools can help take your business to the next level

If you are still struggling with mortgage lead generation after following these tips, the team at Good Vibe Squad can help. Our wide range of services that include a mortgage CRM, loan officer coaching, and mortgage lead generation can help you transform your current lead generation strategy into one that gives you a constant stream of qualified leads with little effort on your part. To learn more about how our team can help you, book a strategy call today.