Mortgage CRMs are a tool that can make or break a company’s success. They have many great advantages – from their pipeline management services to their marketing services, compliance regulation, and the tackling of tedious tasks that prove to be all too time-consuming for loan officers.

Key Takeaways

- Mortgage CRMs are a tool that can be a make or break for a company’s success.

- Mortgage CRM is a software that provides applications and assistance to mortgage professionals to help them maintain their front-end operations.

- Mortgage CRMs are different from Loan Origination Software (LOS).

The features of Mortgage CRMs include managing contacts, marketing automation, pipeline and referral management, regulation compliance, alerts for events, tracking services, and many more. - Mortgage CRMs are time-saving, boost communication, and promote lead generation.

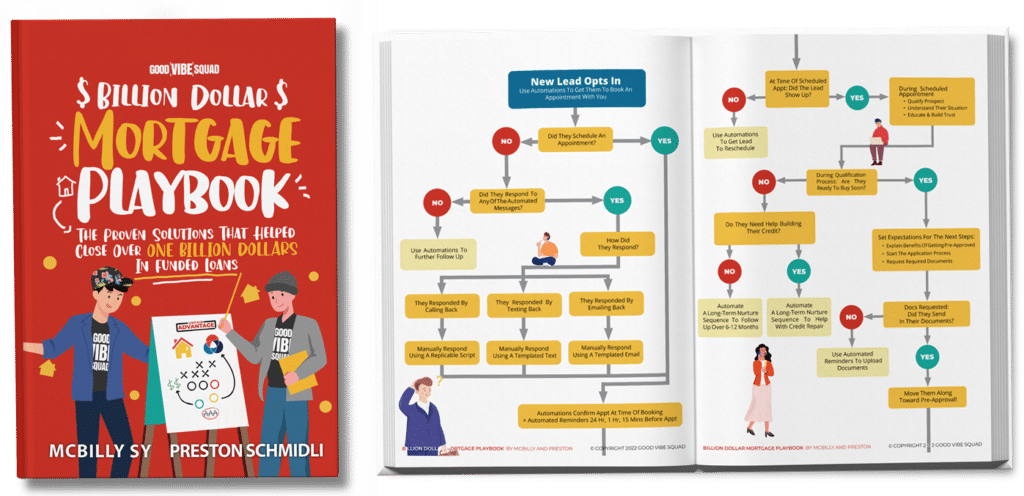

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

What is a mortgage CRM?

Mortgage CRM, or Mortgage Customer Relationship Management, is a software specifically designed to provide applications and assistance to mortgage professionals to help them maintain their front-end operations. Among the many features of mortgage CRM include streamlined relationship and contact management, referral management, marketing automation functionality, and data organization features

Mortgage CRM vs. Loan Origination Software (LOS)

Even though mortgage CRM is a relatively straightforward system, people often confuse it with LOS, or Loan Origination Software.

LOS systems help manage the mortgage lending process by automating certain key systems and addressing challenges that may arise. Typically, it will cover loan applications, underwriting, approval, documentation, pricing, funding, and administration throughout the mortgage loan process.

Mortgage CRM, on the other hand, is more commonly used before LOS comes into play. Lenders use this when converting leads into prospective clients, then applicants, then official clients, repeat customers, and, finally, referral partners.

What are the features of a mortgage CRM?

Mortgage CRMs have many exciting features that can help you turn your leads into clients in no time. Among these include managing contacts, marketing automation, pipeline and referral management, regulation compliance, alerts for events, tracking services, and a whole host of additional features.

1. Managing of contacts

Mortgage CRMs help lenders manage their clients in a number of ways. Most notably, they track and maintain client records across a database designed to an orderly log of all leads, clients, and referral interactions.

2. Marketing automation

Mortgage CRMs are especially valuable when it comes to marketing. They can take the contact information they store and use it to automate email and mobile marketing strategies. It means that they can schedule and send emails, social network posts, or other online marketing types without the need for too much hands-on human interaction.

3. Pipeline management

The pipeline management service mortgage CRMs provide relates specifically to the processes related to the overseeing and directing of sales. These can be current or future sales, including all completed sales, deals, and opportunity pipelines.

4. Referral management

Referral management in mortgage CRMs generally references the steps by which referrals are pushed through various transitional periods in the mortgage loan process. Typically, this begins when a current client makes a referral, but steps are also taken as referrals are contacted, generated into potential clients, and processed through various transitionary steps on their way to becoming borrowers.

5. Regulation compliance

Regulation compliance is a necessary aspect of a mortgage CRM’s service. With it, you can keep up-to-date with any new rules or regulations relating to your field. This is an automated process programmed to prevent any potential rule-breaking. They are input into modules to ensure that brokers, officers, and even clients maintain compliance with the Federal Housing Administration (FHA).

6. Alert for mortgage or loan events

Another great feature of mortgage CRMs is that – while it maintains directories, programs rule-abiding software, and manages all kinds of mortgage-related systems – it can also help officers stay on top of any events. It can include many different kinds of events but is primarily related directly to mortgages and loans. These can range from big network meetings to small, one-on-one client meetings, or even referral calls. With this, no client or event is ever missed.

7. Tracking and analyzing all aspects

Mortgage CRMs can track and analyze pretty much all aspects of the mortgage loan process. From maintaining updated records to keeping on top of marketing strategies and regulations, the system is highly capable of tracking information vital to the business’ success. But more than that, it can also analyze the information gathered to provide accurate, useful results to officers that can help them strategize better when advancing their company.

Other features of a mortgage CRM are:

- Lead Management

- Real-Time LOS Integration

- Extensive Libraries of Campaigns, Emails, and More

- Interactive Mortgage Tools

- Loan Milestone Notifications

- Pre-Written Templates

- Data Analytics

- Call Prompts

- Team-Based, Two-Way Texting

- iOS and Andriod Compatible Mobile Apps

Benefits of mortgage CRM

There are many benefits to getting a mortgage CRM. Let’s look at a few of the top advantages:

- It’s time-saving: Thanks to all of the tasks that mortgage CRMs can automate. You will be able to save a ton of time you would have spent on paperwork, emails, and others.

- It boosts communication: Communication is an invaluable tool, and CRM software can help you promote communication in ways you would have never imagined before. It keeps track of all clients, referrals, leads, and even loan officers so that all contact information is in an easily accessible place. Further, it can take the information it has and uses its pipeline management systems to help move projects along with little human interference.

- Promotes lead generation: Mortgage CRMs are helpful in many ways with their automated services, endless databases, and tools for mortgage officers. But one of the side-effects of excellent CRM software is that it leaves loan officers with more time and resources to pursue and generate leads for their business.

Should you get mortgage CRM software?

Mortgage CRM software has many remarkable advantages that can go a long way toward helping a business thrive and expand. It works had to save loan officers time, money, and undue stress on the job by simplifying tedious tasks, streamlining communication, and even promoting the mortgage lending company through email and mobile marketing strategies.

Read: Why Do You Need Mortgage CRM Software in Your Business?

Every mortgage lending company has to decide whether or not if mortgage CRM software is right for them.

For automated mortgage marketing, check out Good Vibe Squad’s Unfair Advantage™ and book your FREE strategy call to get your customized action plan for more leads and deals.