Loan officers have become an essential part of the financial system, especially in the last few years. They make it possible for individuals to connect with banks or larger financial institutions so they can borrow money from secure lenders. And because of how vital loan officers are to this process, it’s no surprise that the job makes for a good, profitable career.

However, loan officers must rely on the closing of loans to make any money, which begs the question, “Is the career a sustainable one?”

Let’s take a closer look at what loan officers do, how they originate loans, and what their average profit per closed loan is before delving into a few tips to help you increase your close rate.

Key Takeaways

- Loan officers typically originate 18-25 loans a year, but top performers can produce 35-40 loans.

- Loan officers average salaries of $170,000 per year, with most making a 2% commission on each loan they originate.

- To increase closing rates, loan officers should invest in strong marketing, be organized, build their authority, provide excellent customer service, and promise only what they can deliver.

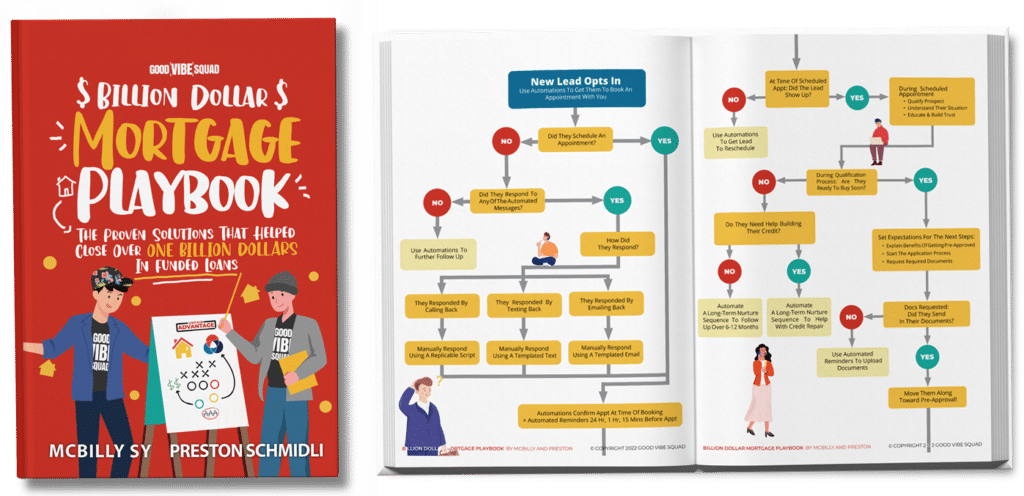

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Loan officers are essential members of the financial community. They typically serve as representatives of banks, lending institutions, credit unions, or other financial businesses. Their job is to meet and evaluate individuals who apply for loans to determine whether to approve or reject the request.

Their role is very similar to that of mortgage loan originators, who work closely with borrowers in the mortgage lending process, but they are quite different from mortgage loan brokers. Mortgage loan brokers are the middlemen who connect mortgage borrowers with respective lenders. Unlike loan officers, they do not provide funds to lend to borrowers. They simply operate paperwork and approval processes between the other two parties.

How many loans does a loan officer originate in a year?

The amount of loans any officer originates in a single year can depend heavily on his business type, whether he works for a bigger bank or is self-employed. Typically, individual loan officers originate approximately 18-25 loans a year, but others can produce more than 35-40. Keep in mind that this can vary widely depending on factors such as your business model, experience level, and the type of loans you specialize in.

How much do loan officers make per loan?

As of 2021, the top 10% of loan officers are averaging salaries of $170,000 per year, but this can widely vary depending on their business model and how many loans they close. Most officers make a 2% commission off of every loan they originate. So, the more work they put in, the more money they get out. This is great news for anyone who wants a career with virtually unlimited earning potential. There are no real caps on how much business you can do in a year beyond how much time you want to put in. Growth potential is always present.

For example, if the average loan officer closes $250,000 loans at 2%, he’ll make $5,000 in profit. Those officers who choose to close one loan a month will typically earn around $48,000 after taxes, while those who do two or three can earn $144,000.

Read more about the Top 10 States to Get Licensed in as a New MLO

Factors That Determine the Number of Loans Closed

As a loan officer, the number of loans you close can depend on several factors. Here are some of the main factors that can determine the number of loans you close:Experience and Expertise

The more experienced and knowledgeable you are as a loan officer, the more loans you are likely to close. Experienced loan officers have a better understanding of the lending process, know how to navigate complex situations, and can provide better guidance to borrowers. Additionally, experienced loan officers often have a larger network of contacts, which can help them generate more leads and close more loans.

Work Ethic

The amount of effort you put into your job can also impact the number of loans you close. Loan officers who are willing to go above and beyond for their clients are more likely to close more loans. This is because borrowers appreciate loan officers who are responsive, available, and willing to work hard to get them the best deal possible.

Market Conditions

The lending market can be unpredictable, and market conditions can impact the number of loans you close. For example, if interest rates are low, you may see an increase in refinance applications, which can lead to more closed loans. On the other hand, if the housing market is slow, you may see a decrease in purchase applications, which can result in fewer closed loans.

Company Support

The level of support you receive from your company can also impact the number of loans you close. Loan officers who work for companies that provide strong marketing and lead generation support may have an easier time generating leads and closing loans. Additionally, loan officers who work for companies that offer competitive compensation packages and incentives may be more motivated to close more loans.

Tips on how to increase closing rate

Since your salary potential is only as limited as the number of loans you close, you need to know the best ways to close as many loans as quickly as you can. Let’s look at some top tips for boosting your closing rate:

1. Invest in strong marketing

Marketing your services is important to gaining new clients. After all, in this digital age, you can’t rely on word of mouth forever. Remember, the number of deals you close and the amount of income you make are directly tied to how much business you do–how many clients you bring in and how many deals you close.

Make sure to invest in regular prospecting practices to bring in these new clients. Yes, it can be a lot of hard work. Fortunately, there are many strong lead-generating, marketing-centric businesses and software programs today that can help you automate some of those processes to save you time and money.

2. Be organized

Being organized is one of the most essential parts of any business. If you can’t keep track of meetings, client information, and other important paperwork in an organized manner, you’ll waste half of your valuable time. You’ll constantly look for things and try to cover with clients whose meetings you missed. Instead, take the time to set up a solid organizational structure that you can stick to. It may take more effort at first, but in the long run, your communication flow will improve, your productivity will increase, and you won’t waste time.

3. Build your authority

The world today runs online. Advertising, social interactions, education, news, gaming, shopping, and much more have all moved to the world wide web. Hence, it’s more vital than ever to have a strong online presence. When individuals today look into different companies and loan officers to work with, they may ask for referrals from friends and family. However, no matter who is recommended to them, they’re sure to run an online search.

If your lending offices have a strong online presence, it will build the borrowers’ trust in your authority. You can use it as an opportunity to provide value to your clients and the industry as a whole by teaching them about various loan processes and terms. If you don’t have an online presence, the opposite is true. You’ll be seen as untrustworthy and lacking in value and authority.

4. Provide a good customer experience

Customer service needs to be one of the highest priorities of any business. After all, without customers, who will borrow your loans? Make sure that you have a professional attitude. Work with your customers as partners in the loan processes to help them feel confident and in control of the situation. Be understanding and encourage honest feedback, even if it’s negative, because it can help you improve your future customers’ experiences.

5. Promise a little, deliver a lot

One of the most common rules of social, community-driven life is not to make promises you can’t keep. Doing so makes you seem untrustworthy and, eventually, no one will take anything you promise with any seriousness. The same is true when you are working with clients. Make sure to promise only when you are 100% sure you can deliver and then blow their socks off when everything else falls into place. Your clients will be ecstatic at the higher quality of service you provide.

Moving forward & closing more

There’s only one award-winning mortgage marketing agency that can say they’re the #1 Lender preferred lead gen, coaching, CRM, and marketing solution all in one. Hint: It’s Good Vibe Squad. See how over a thousand loan officers have supercharged their production, referrals, and relationships with a proven conversion system that works in ANY market.