Before you buy mortgage leads, you need to make sure you know what quality control measures you should take to avoid spending money on the wrong leads.

Buying leads can be a beneficial marketing strategy, but it comes with risks if you’re not experienced buying from a vendor. If you want to maximize your opportunity for success when investing in lead companies, here are eight things you should consider.

While we advocate digital marketing opportunities like advertising and using social media platforms, we know that directly contacting qualified prospects leads to conversion when a prospect is targeted correctly.

Purchasing quality mortgage leads can help produce new clients. A quality mortgage lead is a prospect whose contact information has been acquired because they are interested in becoming a home buyer. You want to make sure that if you choose to invest in leads, you ask the appropriate questions to make sure the prospect is within your target client acquisition niche.

Key Takeaways

- Buying mortgage leads can be an effective marketing strategy, but it comes with risks if you don’t do your research.

- Consider budget, referrals, lead source, return policy, quality over quantity, filtering options, customer service, and exclusive vs. nonexclusive leads when choosing a lead-generating company.

- Buying exclusive leads can be beneficial as they are only sold to you, but they are more expensive.

- You can also generate leads for free by engaging on social media, having a professionally designed website, and partnering with local real estate agents.

- Make sure to do your due diligence and consider all options before investing in mortgage leads.

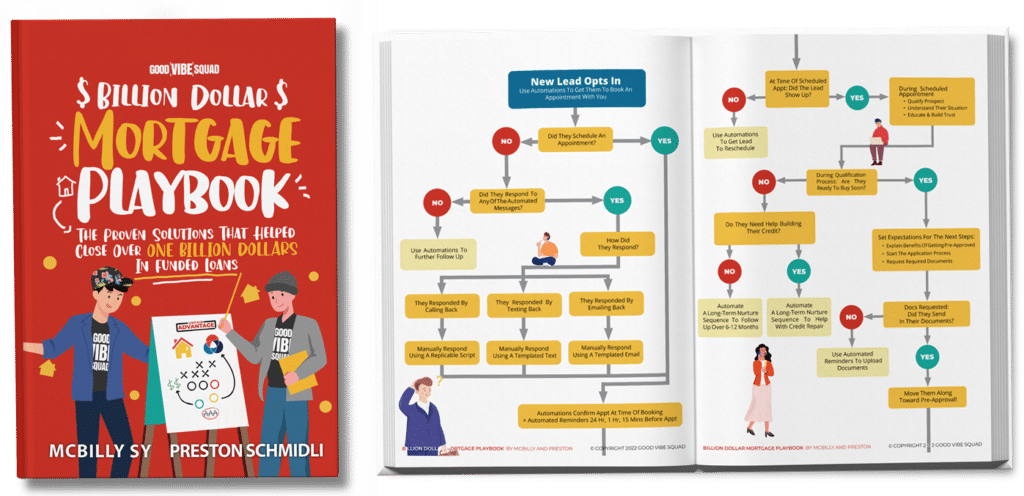

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Is buying mortgage leads effective in generating quality leads?

Is buying mortgage leads effective in generating quality leads?

The benefit of buying mortgage leads is that you get leads immediately. This allows you to update your pipeline and get back to focusing on closing deals.

The disadvantage of buying leads happens when you don’t do enough research about the quality of leads provided. Some leads have been sold several times and have already been contacted by other loan officers. You may be the fifth or even sixth person who’s called them.

Some unethical lead-generating companies will sell leads that are outdated. Leads get resold on the market repeatedly.

If you purchase poor-quality leads, you risk wasting money. If you would like to know key strategies that will immediately increase your lead quality, check out our mortgage lead generation solutions.

Research the company before buying leads

Always research a lead generating company before going into contract with them. Check out their reviews to see what the biggest complaints are. This will save you the hassle of finding out the hard way about customer service issues, quality issues, and more.

When considering which lead generating company you want to work with, be sure to take the following into consideration:

1. Budget

The first thing to consider with any marketing strategy is budget. Plan your budget and stick to it. Don’t rush to buy leads and don’t fall for a good number just because it’s in your budget. If you have an expansive budget, you have more flexibility for the quality level and quantity level.

2. Referrals

If you have any colleagues that you trust who use lead purchasing services, ask for referrals. Ask them about their experience with the companies they work with.

3. Lead source

During your due diligence phase, you would want to investigate the companies you want to do business with to ensure you are getting the best quality leads. Once you find companies you are interested in working with, ask them about their lead sourcing strategy.

Find out:

- Where do they get their leads (direct acquisition or through other lead purchasing companies)?

- How long have they had the leads?

- How do they update information?

4. Return policy

Look for a company that has a reasonable return policy. For example, if you buy a lead and the contact information is not valid, you should be able to get a return on it.

5. Quality over quantity

Some lead companies will boast that they can give you a lot of leads for a great deal. It sounds good at first, but it’s important to make sure you know the quality of your leads.

Leads sold in bulk are often poor-quality leads that have been resold on the market. The acquisition process is careless. You may end up getting leads that were just on a home buying website because a Facebook Ad promised the chance to win a car for filling out a form. They probably don’t want to buy a home. They wanted a free car.

Quality leads are more expensive, but they have a higher conversion opportunity rate. You will end up paying a lot more for quality leads. It costs more because the lead-generating company puts in more effort during the acquisition phase to bring you a more filtered lead.

6. Filtering option

Filtered leads go through a qualification process that allows buyers to have a higher conversion opportunity. A filtered lead could be specified as an interested first-time home buyer, an interested home buyer who is a veteran, by income level, location, and more.

Filtered leads are more expensive, but you have a better advantage of not wasting time on the wrong ones.

7. Customer service

Make sure the company you are working with is responsive to phone calls and emails. Pay attention to the consistency of information they offer. Ask more than one person the same questions to make sure I get the same answer.

8. Exclusive vs. nonexclusive

If you want to really step up your lead purchasing game, you have the option of buying exclusive leads. For a higher price, you can have fresh leads that are only sold to you by the company. This is beneficial because you will not be one of many loan officers calling the same person in a competitive rush.

Non-exclusive leads will save you money. They are typically half the cost of exclusive leads. However, keep in mind that the leads have been sold to several other people. Imagine the lead getting the same experience most people get when filling out an online car insurance quote form. A rush of insurance agents scramble to be the first in line to call the person- and it shows.

Can you get mortgage leads for free?

Buying leads is a legitimate way to increase your pipeline, but it does offer the lowest conversion rate of return. Other more effective options you have are leveraging your online presence and your network.

Engage on social media

Social media marketing is an interactive way to create leads. You can build your brand awareness and increase traffic to your website sales funnel. It is a flexible way to provide short content marketing through posts and videos.Have your own website

Anyone can make a website these days. However, having a professionally designed, easy-to-navigate website with content marketing in place can help establish your credibility.

When your website has the right software in place for qualifying and funneling your prospects appropriately, the conversion rate is higher. People visiting your website found you instead of you searching for them.

Partner with local real estate agents

Networking and industry partnerships are powerful lead-generating opportunities. Leverage your network and partner with your local real estate agents. They are already working with buyers. You can help your real estate partner get their clients the best loan.

You have options

Buying mortgage leads from companies is an option loan officers use to get new leads for their pipeline. Always be diligent about researching the company before deciding on that option.

There are many mortgage lead-generating strategies you can use to increase your sales. If you have any questions about the best lead-generating option for your business, schedule a strategy call with us.