A strong referral network is vital to building trust in your financial transactions and competitive portfolio. A referral network is a collection of individuals who recommend the business to one another, and it’s an excellent method to expand your customer base.

If you’re a loan officer, you should constantly be on the lookout for referral opportunities. Furthermore, making sure everyone in your network knows about them definitely can help.

Read on and learn how to develop your referral network optimally.

Key Takeaways

- Building a referral network is essential for loan officers to increase revenue and expand customer base.

- Loan officers can utilize social media, real estate agents, local events, current and previous clients, and building genuine connections to build their referral network.

- Social media is an untapped marketplace that loan officers can leverage to broaden the audience for their services and improve their search rating.

- Real estate agents are excellent to network with and ask for referrals since they’re constantly building their leads list just like loan officers.

- Building genuine connections with clients is essential to learn about their network and ask for referrals.

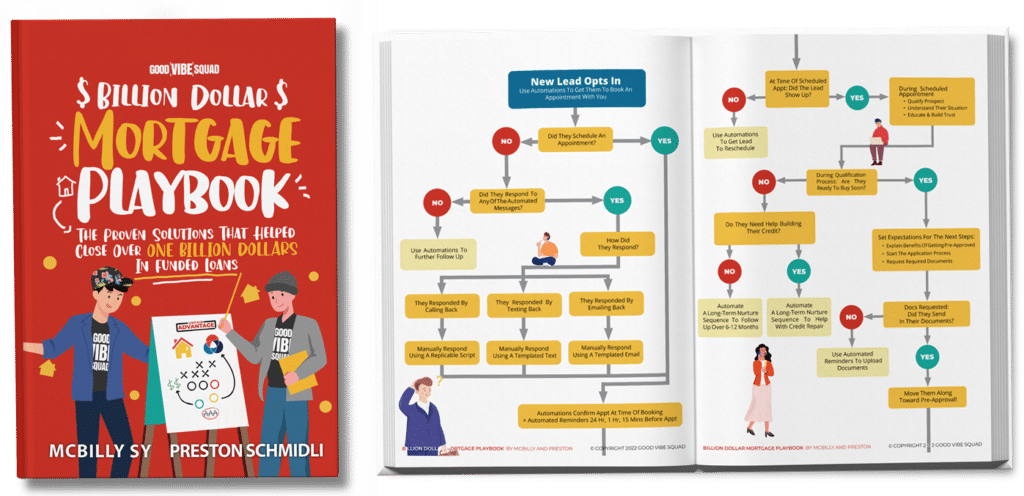

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Importance of building a referral network

A referral network is vital for several reasons. For starters, it may increase your revenue so you can become fully self-sustaining. Also, having a solid networking organization with qualified members means you recommend new clients to each other.

People who only conduct business via recommendations have established referral networks (e.g., lawyers, local businesses). Join one of these groups or establish your own within your business.

You’ll immediately get access to a large number of prospective clients since everyone in the group is interested in recommending each other’s current customers.

Is it difficult to build a loan officer referral network?

As a loan officer, you know how important it is to have a strong referral network. With so many other loan officers out there, it is hard to stand out from being just another professional. And it’s more challenging if you’re new.

So here are some strategies you can use to help you.

Strategies in building a loan officer referral network

According to this statistic, 81% of top loan officers make referrals to earn referrals. Connect and engage with your network and watch who’s also helping to give back to you. Also, take notice of who’s active in building their own leads list.

These are the types of people who can really add value when you’re building your own list of leads and potential clients. Just be sure that you’re giving back to them too!

1. Social media

In the realm of referral building, social media is still king in today’s digital landscape. But, according to Loan Officer Hub, only 20% of top loan officers use social media. It’s still an untapped marketplace for you to take advantage of.

Increasing your social media presence has several significant advantages:

- It broadens the audience for your website and services.

- You may promote your services for free by putting links to your company website on social media platforms.

- Your search rating improves as well since Google and other search engines favor websites with plenty of inbound links.

Follow these easy steps to improve your social media presence and referral network:

- Join relevant social media sites and link to them on your website to build your prospect database.

- Constantly update relevant material to keep people engaged.

- Remember, you’re on social media, so keep things current or “evergreen” (relevant for the long haul).

- Become a market authority by adding external links from professionals who provide relevant information.

2. Real estate agents

As a loan officer, you want to seek out assistance from people that share your target demographic. These experts can help you establish a strong referral network since their clients are searching for the same services you offer – there’s no excuse not to ask for recommendations.

Besides the obvious reasons, real estate agents are great to network with and ask for referrals because they’re constantly building their leads list just like you. But more importantly, their clients are typically the exact type of client you want to secure too. As real estate agents help people to buy homes, these homebuyers will most likely need your services.

3. Establish a local presence

Attending local activities is another method to meet referral partners. These gatherings are always crowded with networkers. Also, statistics show the significance of this approach, with 42 percent of top loan officers attending events.

Introduce yourself to everyone you meet at these events if you haven’t made this a practice yet.

An easy place to start is at your local chamber of commerce, which you can find through a quick Google search. Many people go to such events with business opportunities in mind, and it’s much easier to connect with potential leads or referrers in that environment.

4. Current and previous clients

Contacting existing or former customers builds rapport and generates recommendations, too.

Because current customers already know about your company and your services, it’s simpler to persuade them to recommend someone who needs what you have to offer.

Be sure to be genuine when you reach out, taking an interest in whatever they choose to share with you. In exchange, you may inquire whether they know of anybody else who could require your services.

5. Build genuine connection

Making genuine connections with current clients is a great approach to learn about their network. This has to do a lot with being a good communicator.

For example, say your client has just moved into their new home and you’ve really been communicative with them the whole time. They’re so happy with your service and support and thank you for everything.

That’s the perfect time to ask your client for a referral from their friends or acquaintances. You don’t always need to wait until the final transaction has finished; you can ask right then and there, especially when your client has expressed how valuable you’ve been to the process of getting them into a new home.

Start building a solid referral network.

Building trust in your financial transactions requires a strong referral network.

This is because people are often most willing to purchase from people and companies they know and trust or have been recommended by friends.

And it’s also something that you can do without any complicated process; just be consistent and find what works best for you.

If you need help building up your customer base using this method, Schedule a strategy call with Good Vibe Squad today for more information about how we make it easy!