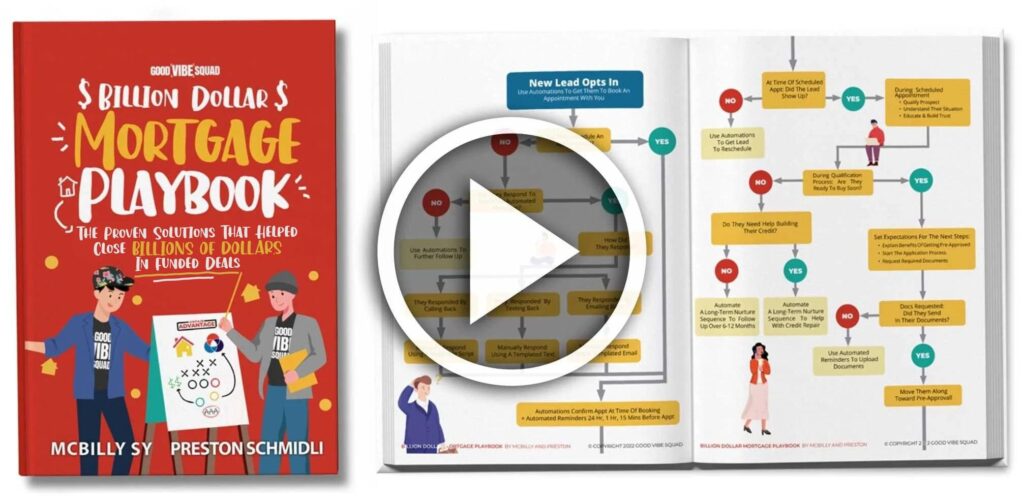

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Here’s the harsh truth about why most lead generators come up short.

Problem #1: Your leads are uninformed

As a loan officer, you have to put yourself in the prospect’s shoes. After a long day of work, Susie Homebuyer is trying to whip up dinner and get the dishes done so she can relax for a bit before bed. Your leads are people, and people are busy! You can’t expect leads to spend every waking minute educating themselves on the process of buying a home. That’s why most interested borrowers don’t know what the approval and closing process look like.

Prospects have a million things on their mind. But if you can cut through the noise and educate them on the next steps toward reaching their dream home, then your leads will be more open to hearing what you have to say.

The best way to build trust with your clients is to educate them on the process of buying a home.

Problem #2: The leads are not interested or qualified

If a lead generator doesn’t have a way to filter out people who aren’t interested or probably won’t qualify, then that lead generator isn’t worth your money OR your time! Your day is already packed with serving clients, dealing with realtor partners, and managing your business. There are not enough hours in the day to talk to leads that can EASILY be filtered out on the front end. When choosing a lead generator or marketing company, see if they have a way to filter out the low-quality leads.

Problem #3: The ads aren’t specific to area/occupation

Every mortgage lender has their own territory. Let’s say you’re a lender in Michigan. You pay a marketing company to advertise for you. If that company is posting ads that are not specific to borrowers in Michigan, then those ads are going to crash and burn.

Picture this, an interested borrower is scrolling through their feed, and they see an ad of a beautiful home set in sunny California with palm trees in the front yard. Do you really think a homebuyer in Michigan is going to click on an ad set in California? Heck no! That’s why the marketing company HAS to use better images that are area-specific in order to reach your ideal clients.

In addition to being area specific, a lot of lenders have their own preferences when it comes to their ideal client’s profession. Depending on what perks you have to offer, you may really like to work with teachers, first responders, veterans, etc. Whatever types of clients you love to work with, your lead generator ought to have a solid way to reach that target audience.

Problem #4: The leads aren’t exclusive

No prospective homebuyer wants to work with the 3rd mortgage lender to call them that day. That’s why the first lender to get in contact with an interested lead has ALL the leverage. If you’re paying for leads, then you shouldn’t have to compete with other lenders for prospects.

For this reason, a lot of mortgage lenders use some type of automations to catch leads before they slip away. Automations are great, but only the cutting-edge automations are worth your money. It’s crucial to have a detailed system that personalizes your automations as much as possible. When a lead receives an automatic message from you, that message should NOT read like a robo-text.

Problem #5: The lead generator is a risky investment

I hate to say it, but most lead generators come with ZERO guarantees of a return on investment. You’d be surprised how many mortgage lenders drop thousands of dollars just to break even or, worse, take a major loss. As a loan officer, you have to invest in yourself to grow your mortgage business, but taking huge risks on marketing strategies that fall flat will only add on more stress. If you’re like most lenders, you work your butt off every day to grow your business. At the very least, you deserve some guarantee that you’ll make your money back AND then some.

Problem #6: It takes too long to build a solid relationship

Playing phone tag with a lead can be a huge hassle. Until you get them on a phone call and build that relationship, that prospect isn’t going to see you as a human being. It’s hard to offer a personalized touch through texts, especially if you’re using automated follow-ups that read like robo-texts. When choosing a lead generator or a marketing system, you want to invest in the strategies that help you quickly build a solid relationship with your prospects, so you can take apps and move them right along toward a closed, funded deal.

The takeaway? You have a TON of responsibility riding on your mortgage business. You’re probably overwhelmed with the day-to-day workload and may not have time to seriously scrutinize your marketing strategies. Still, you don’t want to get burned by a half-baked marketing system. So make sure to keep an eye out for these red flags.

If you want to learn more about the RIGHT way to invest in your mortgage business, schedule a FREE strategy call with us to learn more about this cool new marketing solution that comes with an ROI guarantee