Comprehensive Guide To Mortgage Marketing & Sales Training

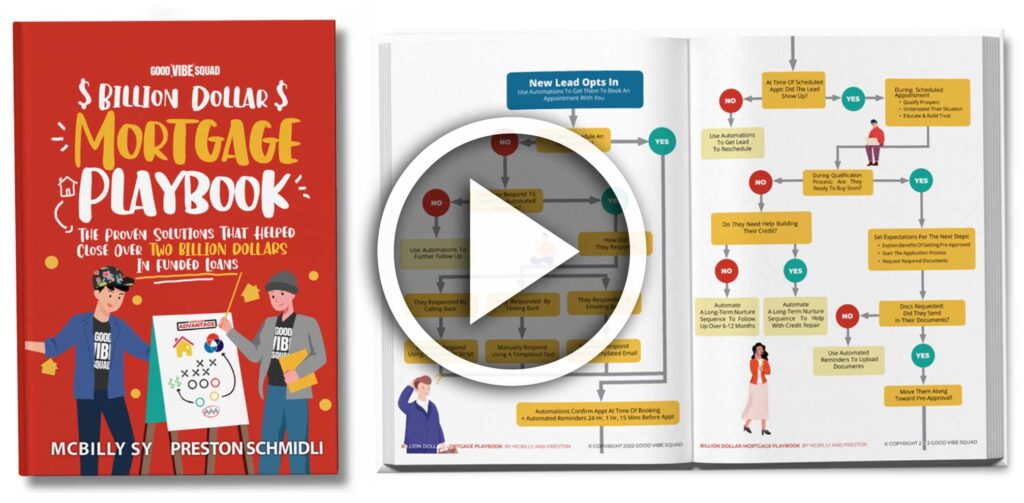

After helping and coaching hundreds of loan originators help closed billions of dollars of funded loans directly from our system, we understand the evolving landscape of the mortgage industry and the challenges loan officers face when growing your mortgage career.

Understanding how to effectively market in this competitive market, attract home buyers, and grow their mortgage business without losing their personal life. The key to success lies not only in understanding the intricacies of the lending market (and your mortgage products) but also in mastering the art of marketing and sales.

Whether you are a seasoned mortgage professional seeking to refine your skills or a new loan officer looking to establish a strong foundation, build your database of clients and referral partners, these training videos are tailor-made to equip you with the tools needed to succeed in today’s dynamic market.

Start Here As The Foundation: The Best Marketing Strategy To Exponentially Grow Your Mortgage Business

Want us to help you with this?

There’s a lot of marketing strategies that you can implement, but it’s first important to understand that we want to build a foundational business strategy so that we can not wasting your energy and efforts when you start taking action.

Usually loan officer marketing revolves around understanding your 3 M’s:

Market (Audience): This is your target audience and ideal customers. People often go straight to trying to figure out if they need to be in social media or what platforms they need to be posting in (example: Facebook, Instagram, TikTok or YouTube) and the truth is that any of those social media platform can be very effective! But you need to start to define first who is your target market!

One of the fundamental steps in developing a successful mortgage marketing strategy is identifying your target market and niche. Understanding your ideal clients’ demographics, needs, and preferences allows you to tailor your messaging and offerings to resonate with them.

Consider factors such as age, income level, geographic location, and specific financial goals. Additionally, finding a niche within the mortgage market can give you a competitive edge. Whether it’s first-time homebuyers, real estate investors, or self-employed individuals, focusing on a specific segment allows you to position yourself as an expert and develop specialized marketing campaigns that directly address their unique needs.

If you are selling to everyone, then you are selling to no one!

Message (Offer): Next thing to define is your message or what is your offer to your target audience. If you are selling on how amazing your customer service is, how fast your close and that you have the “best rates” then that is exactly what everybody else is selling on.

You need to understand and define first your UNIQUE SELLING PROPOSITION (USP)

In the training video below, I will walk you through 7 different unique selling propositions that you can leverage to make your messaging unique to your target audience as a mortgage loan originator!

Set up your unique selling proposition

Media (Platform): Last but not least is clarifying what media or platform should you leverage. And if you were able to successfully define who your target audience is and what your message is, this will help dictate which platform you can leverage since each social media platforms has their differences on who are on those platforms!

In today’s digital age, having a strong online presence is essential for mortgage marketing success. Start by creating a professional website that showcases your expertise, services, and testimonials from satisfied clients. Optimize your website for search engines to improve visibility in search results.

Leverage content marketing strategies, such as creating informative blog posts and videos that address common mortgage questions and concerns. Utilize social media platforms to engage with your audience, share valuable content, and establish yourself as a trusted authority in the industry. Additionally, consider paid online advertising options, such as search engine marketing or social media advertising, to expand your reach and generate leads.

Lastly, cultivating referrals and strategic partnerships is important. Referrals can be a powerful source of new clients in the mortgage industry. Develop strong relationships with past clients and encourage them to refer their friends, family, and colleagues. Offer incentives or referral programs to incentivize referrals.

Additionally, consider forming strategic partnerships with real estate agents, builders, financial advisors, and other professionals in related industries. These partnerships can lead to mutually beneficial referrals and collaborations. Attend industry events and networking functions to expand your professional network and establish connections that can fuel your mortgage marketing efforts.

Remember, building trust and nurturing relationships is key to generating a steady stream of referrals and long-term business growth.

Learn To Leverage Trust-Based Marketing In This Training Video

Grow Your Mortgage Business GUARANTEED

After nurturing and connect with your prospects and ideal customers, it’s important to have a systematic sales process because sales is all about consistency of actions and a numbers game.

There are several phases in having an effective sales process:

Establish a Rapport and Build Trust: When selling people on the phone, building a strong rapport and establishing trust is crucial. Start the conversation by greeting the prospect warmly and introducing yourself with confidence. The more you can connect with them on this phase, the easier it is to gain their permission for you to help them!

Take the time to listen actively and understand their needs, concerns, and goals. Empathize with their situation and demonstrate your expertise by providing valuable insights and solutions tailored to their specific circumstances.

Use clear and concise language to explain the benefits of your mortgage service, focusing on how it can address their needs and help them achieve their financial goals. By building trust and showing genuine care for their success, you create a solid foundation for the sales conversation.

Highlight Unique Value Propositions: To effectively sell your mortgage service on the phone, it’s essential to highlight your unique value propositions that differentiate you from competitors. Clearly articulate the key advantages of your mortgage offering, such as competitive interest rates, flexible repayment options, or specialized programs for specific client profiles.

Emphasize any unique features or benefits that set you apart from the competition and address the prospect’s concerns or pain points. Use persuasive language and storytelling techniques to paint a compelling picture of how your mortgage service can positively impact their lives. Back up your claims with testimonials or success stories from satisfied clients to further strengthen your credibility.

Overcome Objections and Close the Sale: Overcoming objections is a critical step in successfully selling people on the phone. Address any concerns or doubts they may have, and provide clear and transparent answers. Be prepared to handle common objections, such as interest rates, fees, or eligibility criteria, by explaining the value and benefits that outweigh those concerns.

Use effective communication techniques, such as active listening and mirroring, to establish a sense of understanding and empathy. Once you have addressed their objections and built sufficient trust, confidently ask for their commitment.

Use closing techniques, such as offering limited-time incentives or highlighting the urgency to take advantage of current market conditions, to encourage them to move forward with your mortgage service. Remember to be respectful and professional throughout the entire sales process.