Trying to keep up with the constantly moving parts of contact management and opportunity management doesn’t have to be complicated.

Contact management software can help you streamline your client relationships while managing your opportunities simultaneously. This article will help you understand the difference between contact management and opportunity management within the sales workflow.

Customer relationship management is a key element to a thriving business. Having the right systems and tools in place to simplify and automate processes can help your business present a professional and polished customer experience.

The difference between a striving company and a thriving company is often in the quality of business systems in place to manage the workflow of the sales process. With the right industry-focused customer relationship management system (CRM) and the right workflows in place, you can have an efficient strategy for:

- Prospecting

- Contact Management

- Opportunity Management

CRM software is the not-so-secret formula that allows businesses to increase revenues significantly. Businesses using CRMs increase their sales by 29% on average (review42.com).

Key Takeaways

- Customer relationship management (CRM) is important for businesses to increase revenues significantly.

- A CRM system includes contact management and opportunity management.

- A prospect is a potential customer who has entered your sales workflow through a traffic source.

- A lead is an interested potential buyer who has engaged in an initial offer or opt-in form.

- Opportunity management focuses on workflows that concentrate on closing a deal, while contact management focuses on managing the relationship with existing or potential customers.

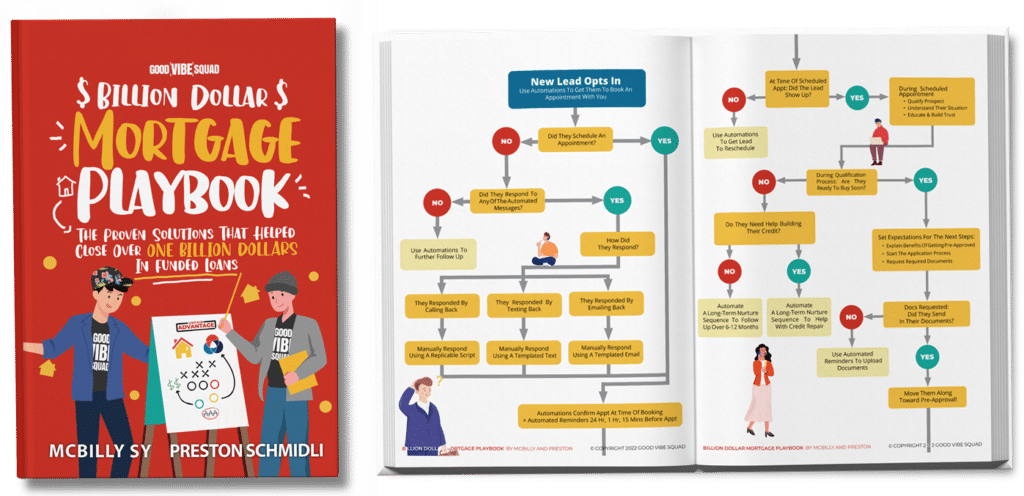

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Prospect vs. leads vs. contact vs. opportunities

When using a CRM, you will come across common terms like:

- Prospect

- Lead

- Contact

- Opportunity

These key terms are vital to communicating the sales workflow within a contact management software platform. These terms are often confused and intermingled with each other. Each term is not just a label, it is an indicated action within the sales workflow.

One of the biggest mistakes made in marketing is pitching offers to a prospect before qualifying them as a potential customer. Qualification requires investigation. The investigation leads to making the right offer based on the relationship development phase of the sales cycle.

To better understand the sales workflow, let’s define the terms better.

What is a prospect?

A prospect is a potential customer that has entered your sales workflow through a traffic source. This can be an ad, a website, a marketing event, or a referral.

One way to attract a prospect is to use our Unfair Advantage™ marketing strategy. We create attention-grabbing ads to target your ideal clients. These ads are crafted strategically to increase your lead conversion rate.

A prospect clicks on your targeted ad to find a new solution for mortgage loan approvals for VA loans. The prospect is directed to your lead-generating website, where they find valuable content that builds trust in your credibility.

You want the prospect to become a customer, but, before you get to that step, you need to qualify the prospect before converting them into a lead.

What is a lead?

Once the prospect has established a desire to engage with your business, they will go through additional qualification steps and consent to take an application survey to verify that they can qualify for a home mortgage.

Once a prospect engages by accepting your opt-in questionnaire, you will have their contact information. This is when your prospect converts to a lead.

A lead is an interested potential buyer who has engaged in an initial offer or opt-in form. It’s up to you to make sure that they receive the right offer by understanding the data gathered during the lead nurturing phase.

Lead nurturing takes place when a potential buyer meets certain attributes for becoming a potential client in the future. However, they are not ready for immediate purchase. When you manage your contact consistently, you manage the relationship, which can turn into future sales.

Once a prospect converts to a lead, it’s your responsibility to build trust by providing valuable content and resources. The Unfair Advantage system allows your ideal clients to become educated ahead of time about the process of buying a home before the first appointment with you is scheduled.

What is a contact?

Now that the leads have opted in, they initiate the additional filtration application process and will be guided through a customized home buyer educational experience. They initiate contact with you by scheduling an appointment on your calendar.

When a pre-qualified lead contacts you, they are taking the initiative and showing a desire to conduct business with you. This is when a lead becomes a contact, and you make the move.

What is an opportunity?

Converting a contact into an opportunity is the beginning of the opportunity management process. This is when both parties are ready to do business with each other, and it’s time to track the deliverables for closing the deal. For the mortgage loan industry, that can look like:

- Loan application process

- Acquiring verification documents

- Pulling the credit report

- Pre-approvals

- Additional manual application process (if required)

Contact management vs. opportunity management

There is a distinct difference between contact management and opportunity management. Although both can be managed within a CRM, there is a different procedure to follow. One is focused on customer relationship activities, and the other focuses on revenue-producing activities.

Contact management

Contact management can focus on new or existing customers. Once you record contact details initially upon account setup, you will be able to record any interactions between the contact and associate to manage the relationship and take them through the appropriate funnel to initiate guided activities.

Opportunity management

Opportunity management focuses on using workflows that concentrate on closing a deal. Workflows can include custom activities that are assigned to a specified user, including realtor partners and borrowers.

Converting leads to opportunities

Using the previous examples, let’s continue the progression for converting your lead into an opportunity.

The borrower has met all the pre-approval requirements and the approval process has started.

Converting a lead into an opportunity is a data-driven decision based on the genuine probability of closing the deal. Some sales account managers make the mistake of converting a lead into an opportunity too soon before they can confirm that the lead meets the requirements.

If you are converting the wrong leads into opportunities, it can impact the accuracy of your reporting. For example, a loan officer may convert a lead into an opportunity before conducting the pre-qualification to validate that the lead meets the bare minimum requirements for loan approval. In this case, the application can be rejected, and the salesperson may have to close the opportunity as a loss.

This impacts the validity of your sales metrics. The close-to-won ratio will be inaccurate.

Define your lead-conversion process

You want to avoid converting a lead into an opportunity prematurely. The best way to do this is to have a clear picture of your process. Define the workflows and steps necessary for confirming a genuine opportunity. If you need help creating a process, you can schedule a quick call to speed up your marketing growth strategy. We have the templates in place so that you don’t have to start from scratch.

The pre-approval phase is the most important stage in the mortgage loan process. It saves you and the borrower time. The pre-approval stage should be integrated into your lead conversion process.

Qualify the lead to close the deal

If you don’t have a diligent qualification process in place, you risk clogging up your opportunity pipeline with non-sales opportunities that waste time. If you are focused on deals that won’t close, you will waste valuable time and miss out on genuine opportunities.

The mortgage loan industry is complex and requires a very intensive process of pre-approval, application, verification of debt, income, and assets. This is why having a business system in place with detailed lead management processes is important. Having the right system and processes in place guarantees that your lead is the right match for your business.

Close the deal

When you have a clear picture of the differences between your prospects, leads, contacts, and opportunities, you can define a sales process that allows you to streamline your workflows for efficiency. Using the right contact management software will enable you to achieve this fluidity. When your process is efficient, your time is used effectively.

Having an efficient system in place allows you to attract, engage and qualify a lead. Once qualified, your opportunity is matched, and you can make the right offer. The perfect match means the perfect deal.

Learn more about how we can help you can close more deals – schedule a call with us now!