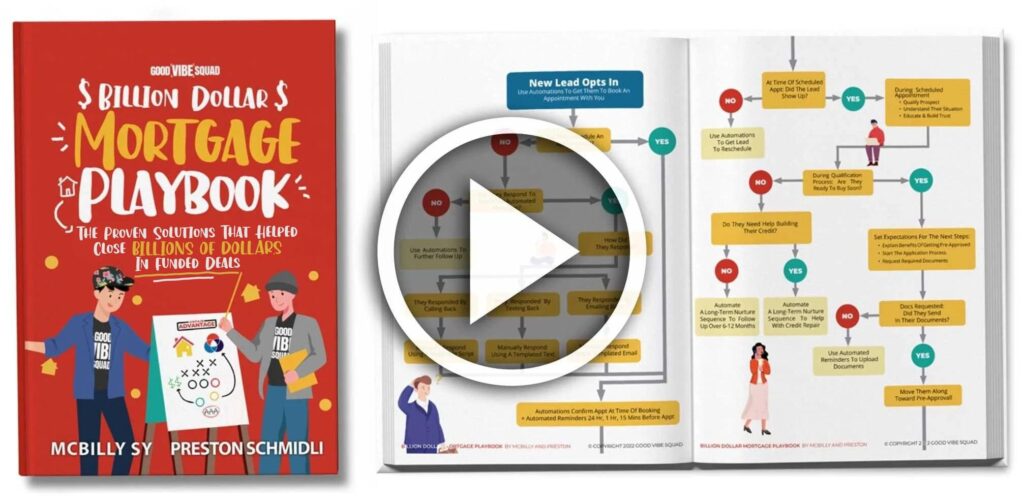

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

For mortgage lenders, growing your business is no easy task. Here’s how to set the right expectations about the road ahead.

Phase 1: Uninformed optimism

Maybe you’re somewhat new to the industry, or maybe you’re trying a different marketing strategy. Either way, this big change makes you hopeful for the future! You haven’t quite gotten into the nitty gritty of how this shiny new opportunity will work. At this point, you’re a little naive about the time and the work it will take to reach your goals. Despite being uninformed, this phase is crucial for taking the first steps toward a bright future.

Phase 2: Informed pessimism

Uh-oh, you’re not seeing the results in the timeframe you expected. You’re starting to realize “Okay, this is a bit harder than I thought.” But you’re determined to plow ahead toward reaching your full potential.

Phase 3: Valley of despair

This is when the worry really starts to set in. You’re thinking, “Oh, no! I’ve invested all this time & money with NO returns. My business is gonna fail, my life will fall apart. I’m screwed!”

As unpleasant as it sounds, everyone goes through this crisis when learning anything worthwhile. In the mortgage industry, if you’re relying on strategies that are NOT working, then you should definitely re-evaluate. However, there’s a difference between making appropriate adjustments, and giving up altogether.

So yes, have a critical eye to make sure you’re doing the right things for your business, but don’t let fear and self-doubt affect your decisions. When it comes to this dreaded phase, the trick is to keep pushing through! Even though it may not feel like it, your skill set is getting better, and you’re closer toward reaching success.

Phase 4: Informed optimism

Congratulations, you’ve pushed past your lowest low! You’ve made the appropriate adjustments and are more educated about what it takes to succeed. The qualified leads are rolling in, you’re taking applications and seeing REAL results. Finally, your confidence is building back up, and your business is taking off!

Phase 5: Success & fulfillment

Now you have a solid pipeline of qualified borrowers who need YOUR help getting into their dream home. You’ve made enough headway to gather momentum, the stress is melting away, and you have more money & free time to enjoy your life! As long as you maintain your work ethic and keep improving your skill set, it’s only going to get better from here on out.

The takeaway? We’re all human, and while it’s in our nature to challenge ourselves and learn new things, sometimes growth can really suck. These phases are a given part of your life. Just being aware of these 5 phases will help you grow your mortgage business from a more rational, confident mindset. Try applying this knowledge to other areas of your life, and it’ll help you push past self-doubt.

For more resources on growing your mortgage business, learn how loan officers all over the country are funding more deals and schedule your strategy call.