Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Working in the mortgage industry can be especially challenging, but community and loan officer support are readily available no matter how long you’ve been in the industry. This article includes a list of the best resources for financial, professional, and peer support. Some top resources for loan officer support include loan origination Reddit threads, LinkedIn networking groups, and mortgage coaching programs.

Key Takeaways

In today’s fast-paced world, it is critical for individuals to have access to reliable sources that may help them facilitate both personal and professional growth.

LOs can access support individually or by connecting with others.

- In a competitive market and industry, seeking out loan officer support is a great way to invest in yourself and your career longevity.

1. Get a Behind-the-Scenes Look at the Industry Through Reddit

The subreddit r/loanoriginators is a thriving online forum for loan originators and lending industry professionals. With thousands of subscribers, this subreddit provides a forum for professionals to engage in discussions and swap insights regarding the various elements of loan origination. Members can benefit from each other’s triumphs and problems by offering suggestions to strengthen client relationships or navigate complex financing requirements.

Furthermore, r/loanoriginators serves as a hub for industry news and updates. Members often exchange lending-related articles, blog posts, and research papers. This ensures that professionals are aware of the most recent developments, market situations, and regulatory changes that may have an impact on their work.

Anyone can use Reddit, so you should always take the advice with a grain of salt. But here’s an example of advice given to a new LO in the field who wasn’t sure where they would fit best:

“Call centers can be advantageous simply because of the number of “reps” you get on the phone, looking at all types of deals, arranging loans, and selling. This is the greatest option for you. Even if it stinks, you’ll see 10x the amount of transactions and be more confident when doing self-gen. On top of that, I would read as much as I could about the lending market, trends, rate predictions, and so on, so that you could really get your mind around the business as a whole. MBS Highway ($150/month), Mortgage News Daily (free), and MF Lending (free) are my top choices.”

Within this subreddit, you’ll also find recommendations for test prep courses and resources to help you on your journey to getting licensed. Compliance is incredibly important in this industry, so it’s a good idea to make sure that each program is still NMLS-approved.

Reddit can also be a source of loan officer book recommendations. Here’s a small sample:

- The Little Red Book of Selling

- The Compound Effect

- Atomic Habits

- Ninja Selling

With some quick research, you can find the right Reddit loan originator thread for you. Want to know the average mortgage loan originator salary? Or what it’s like working with particular mortgage marketing companies? Reddit can help.

2. Find Scholarships for Continuing Education Through the Mortgage Bankers Association

For loan officers, the Mortgage Bankers Association (MBA) is a prominent organization that provides access to a wide range of professional development options such as webinars, seminars, and workshops. Being a member of the MBA community also gives you access to networking opportunities allowing you to connect with other loan officers, lenders, and industry experts.

The Industry Resources section includes various scholarships for those within the finance and mortgage sectors. The Path to Diversity Scholarship Program honors current industry professionals who want to further their professions via continuing education. Recipients receive a voucher for up to $2,000 in course registration fees for popular MBA Education courses and credential programs as well as select conferences. This educational opportunity allows employees from a variety of backgrounds to boost their professional development and career advancement.

Scholarships from the Path to Diversity program can also be applied to six MBA Conferences where attendees can earn Continuing Professional Education (CPE), Continuing Legal Education (CLE), or Society of Human Resources Management (SHRM) credits.

Application Requirements and Eligibility

A resume, personal statement, and a letter of recommendation from a current MBA member in one of the following groups are required to submit a full application for the following programs:

- Supervisor/Organization Leadership

- CMB (specifically for CMB applicants)

- National Association of Minority Mortgage Bankers of America (NAAMBA)

- State/Local MBA

- Future Leaders Alumni

- mPact, mPower, or DEI committees

Review Timeline and Evaluation Process

Applications are accepted on a rolling basis, subject to funding availability. The scholarship amount awarded is determined by the course registration chosen. Individuals may get up to three awards over their careers with no more than one award given in any given calendar year.

Applications received by the 15th of the month will be considered by MBA’s Path to Diversity Scholarship Award Task Force by the end of the same month. Applicants will know the status of their applications within 30 days of them being processed. If your application is declined, you may resubmit it at any time.

Applicants must receive a minimum of 75 points out of a possible 100 in order to be approved. The following criteria are used to evaluate applications:

Personal Statement: 50 points

Letter of Recommendation: 50 points

U.S. veterans and disabled applicants will receive 5 bonus points.

Qualified Courses and Programs

Accepted applicants may use their education funds on the following:

- Human Resources Symposium (SHRM)

- Regulatory Compliance Conference (CLE)

- Accounting and Financial Management Conference (CPE)

- Servicing Solutions Conference & Expo (CLE)

- Legal Issues and Regulatory Compliance Conference (CLE)

- Commercial/Multifamily Servicing & Technology Conference (CPE)

Professional Certificates & Designations

- Certified Mortgage Banker (CMB)

- Certified Mortgage Compliance Professional (CMCP)

- Certified Residential Underwriter (CRU)

- Residential Certified Mortgage Servicer (RCMS)

- Commercial Certified Mortgage Servicer (CCMS)

- Chartered Realty Investor (CRI)

Leadership

Residential: General

- School of Mortgage Banking I: An Introduction to the Real Estate Finance Industry

- School of Mortgage Banking II: Managing Profitability and Risk

- School of Mortgage Banking III: Strategic Planning for Mortgage Bankers

- Introduction to Mortgage Banking

Residential: Loan Production

Residential: Loan Administration

Commercial/Multifamily

Multifamily

3. Join a LinkedIn Network

LinkedIn is the premier networking platform of professionals worldwide. In addition to sharing posts and articles, you may consider joining groups with shared interests and goals. Here is a quick list of the top LinkedIn Mortgage Groups:

Mortgage Bankers Association (around 71,958 members)

- For real estate finance professionals who want to network and discuss industry challenges.

Mortgage Professionals (around 58,653 members)

- This forum is intended for mortgage professionals to discuss anything and everything related to the mortgage industry.

Mortgage Professionals Network (around 81,669 members)

- One of the world’s leading associations for mortgage and banking professionals is open to professionals interested in the mortgage and banking industries.

National Association of Mortgage Brokers (around 2,440 members)

- The National Association of Mortgage Brokers is a trade organization representing the interests of mortgage professionals and homebuyers since 1973 and is dedicated to promoting the highest level of professionalism and ethical standards for its members.

America’s Mortgage Underwriters Group (around 14,032 members)

- For professional mortgage underwriters who work with FNMA, FHLMC, FHA, VA, and RHS loans.

FHA Mortgage Facts & Guidelines (around 12,309 members)

- Devoted solely to FHA data and standards.

Mortgage Professionals Worldwide (around 8,463 members)

- A group for mortgage professionals to share information, remain connected, and grow their customer base.

Mortgage Loan Office Support Network (around 3,941 members)

- A group where loan officers and mortgage brokers may share information and encourage one another.

To join these organizations, you must first request membership. However, this is a good thing because it leads to more engagement and better conversations. Topics can range from overcoming obstacles in challenging market conditions to maintaining contact with previous clients. Whatever you’re looking for, these groups are excellent sources of knowledge and networking.

4. Take NMLS Approved Continuing Education Courses

MLO Continuing Education courses are available online through the CE Shop in all 50 states and US territories. The courses are NMLS-approved and completely online. They also meet SAFE Act standards and license renewal criteria.

These courses equip professionals with the information and skills needed to handle the mortgage industry’s ever-changing terrain. Mortgage experts can guarantee that they are giving accurate and dependable information to their clients by staying knowledgeable about new legislation and requirements. This is also a great way to build trust and credibility.

NMLS CE Deadlines

MLO Continuing Education Deadlines

Typically, NMLS advises that you complete your CE before the end of the year. The 2023 CE deadlines are offered below as an example:

- SMART Deadline: December 8, 2023

- At-Risk-to-Miss Deadline: December 15, 2023

- Guaranteed to Miss Deadline: December 29, 2023

MLO Continuing Education Requirements

The SAFE Act requires mortgage professionals, including MLOs and mortgage brokers, to take at least 8 hours of Continuing Education each year in order to keep their license active. These hours must be earned from an NMLS-approved source. Most states require the following hours:

- 3 hours of federal law and regulations

- 2 hours of ethics, including instruction on fraud, consumer protection, and fair lending

- 2 hours of non-traditional mortgage lending

- 1 hour of undefined electives on mortgage origination

Additional hours, known as “state-specific” hours, are necessary in some states to retain licenses. More information can be found in the table below.

| STATE | NATIONAL PE | STATE PE | TOTAL PE | NATIONAL CE | STATE CE | TOTAL CE |

|---|---|---|---|---|---|---|

| Alabama | 20 | 0 | 20 | 8 | 0 | 8 |

| Alaska | 20 | 0 | 20 | 8 | 0 | 8 |

| Arizona | 16 | 4 | 20 | 7 | 1 | 8 |

| California - DFPI | 18 | 2 | 20 | 7 | 1 | 8 |

| California - DRE | 20 | 0 | 20 | 8 | 0 | 8 |

| Colorado | 18 | 2 | 20 | 8 | 0 | 8 |

| Connecticut | 20 | 1 | 21 | 7 | 1 | 8 |

| Delaware | 20 | 0 | 20 | 8 | 0 | 8 |

| District of Columbia | 17 | 3 | 20 | 7 | 1 | 8 |

| Florida | 18 | 2 | 20 | 7 | 1 | 8 |

| Georgia | 20 | 0 | 20 | 7 | 1 | 8 |

| Hawaii | 17 | 3 | 20 | 7 | 1 | 8 |

| Idaho | 18 | 2 | 20 | 7 | 1 | 8 |

| Illinois | 20 | 0 | 20 | 8 | 0 | 8 |

| Indiana - DFI | 20 | 0 | 20 | 8 | 0 | 8 |

| Indiana - SOS | 18 | 2 | 20 | 8 | 0 | 8 |

| Iowa | 20 | 0 | 20 | 8 | 0 | 8 |

| Kansas | 20 | 0 | 20 | 8 | 0 | 8 |

| Kentucky | 20 | 0 | 20 | 7 | 1 | 8 |

| Louisiana | 20 | 0 | 20 | 8 | 0 | 8 |

| Maine | 20 | 0 | 20 | 8 | 0 | 8 |

| Maryland | 15 | 5 | 20 | 7 | 1 | 8 |

| Massachusetts | 17 | 3 | 20 | 7 | 1 | 8 |

| Michigan | 18 | 2 | 20 | 8 | 0 | 8 |

| Minnesota | 20 | 0 | 20 | 7 | 1 | 8 |

| Mississippi | 16 | 4 | 20 | 8 | 0 | 8 |

| Missouri | 20 | 0 | 20 | 7 | 1 | 8 |

| Montana | 18 | 2 | 20 | 8 | 0 | 8 |

| Nebraska | 20 | 2 | 22 | 8 | 0 | 8 |

| Nevada | 26 | 4 | 30 | 8 | 0 | 8 |

| New Hampshire | 18 | 2 | 20 | 8 | 0 | 8 |

| New Jersey | 16 | 4 | 20 | 10 | 2 | 12 |

| New Mexico | 17 | 3 | 20 | 7 | 1 | 8 |

| New York | 17 | 3 | 20 | 8 | 3 | 11 |

| North Carolina | 20 | 4 | 24 | 7 | 1 | 8 |

| North Dakota | 20 | 0 | 20 | 8 | 0 | 8 |

| Ohio | 20 | 4 | 24 | 8 | 0 | 8 |

| Oklahoma | 19 | 1 | 20 | 8 | 0 | 8 |

| Oregon | 16 | 4 | 20 | 8 | 2 | 10 |

| Pennsylvania | 17 | 3 | 20 | 7 | 1 | 8 |

| Puerto Rico | 20 | 0 | 20 | 8 | 0 | 8 |

| Rhode Island | 17 | 3 | 20 | 7 | 1 | 8 |

| South Carolina - BFI | 17 | 3 | 20 | 7 | 1 | 8 |

| South Carolina - DCA | 17 | 3 | 20 | 7 | 1 | 8 |

| South Dakota | 20 | 0 | 20 | 8 | 0 | 8 |

| Tennessee | 18 | 2 | 20 | 8 | 0 | 8 |

| Texas - OCCC | 20 | 0 | 20 | 8 | 0 | 8 |

| Texas - SML | 20 | 3 | 23 | 8 | 0 | 8 |

| Utah - DFI | 20 | 0 | 20 | 8 | 0 | 8 |

| Utah - DRE | 20 | 15 | 35 | 8 | 2 | 10 |

| Vermont | 18 | 2 | 20 | 8 | 0 | 8 |

| Virgin Islands | 20 | 0 | 20 | 8 | 0 | 8 |

| Virginia | 20 | 0 | 20 | 8 | 0 | 8 |

| Washington | 18 | 4 | 22 | 8 | 1 | 9 |

| West Virginia | 20 | 4 | 24 | 7 | 2 | 9 |

| Wisconsin | 20 | 0 | 20 | 8 | 0 | 8 |

| Wyoming | 20 | 0 | 20 | 8 | 0 | 8 |

5. Understand the Laws Regarding Your Compensation

The Truth in Loan Act (TILA) is a federal law that strives to safeguard customers by ensuring loan practices are transparent and fair. Regulation Z, which governs loan originator compensation obligations, is an important part of TILA.

Loan originators play an important part in the lending process. Unfortunately, there have been reports of loan originators abusing their position by participating in unethical actions such as pushing consumers into loans with higher interest rates or fees in order to boost their own pay.

Regulation Z addresses these concerns by putting certain compensation requirements on loan originators. For example, it prevents loan originators from obtaining compensation based on the loan’s terms or circumstances, except for the principal amount borrowed. This eliminates the incentive for loan originators to steer borrowers into bad loans.

While Regulation Z’s loan originator compensation rules are critical for safeguarding consumers from predatory lending practices, there should be a balance struck between consumer protection and fair negotiation. Striking this balance will promote fair lending practices while also boosting competition and consumer access to financing options.

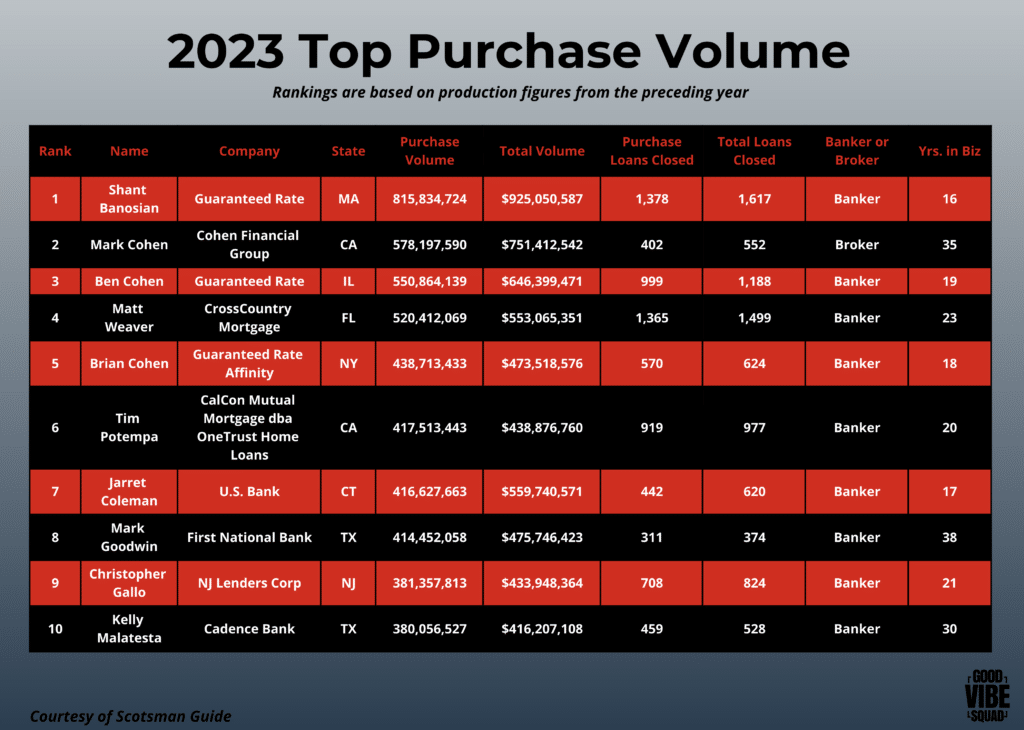

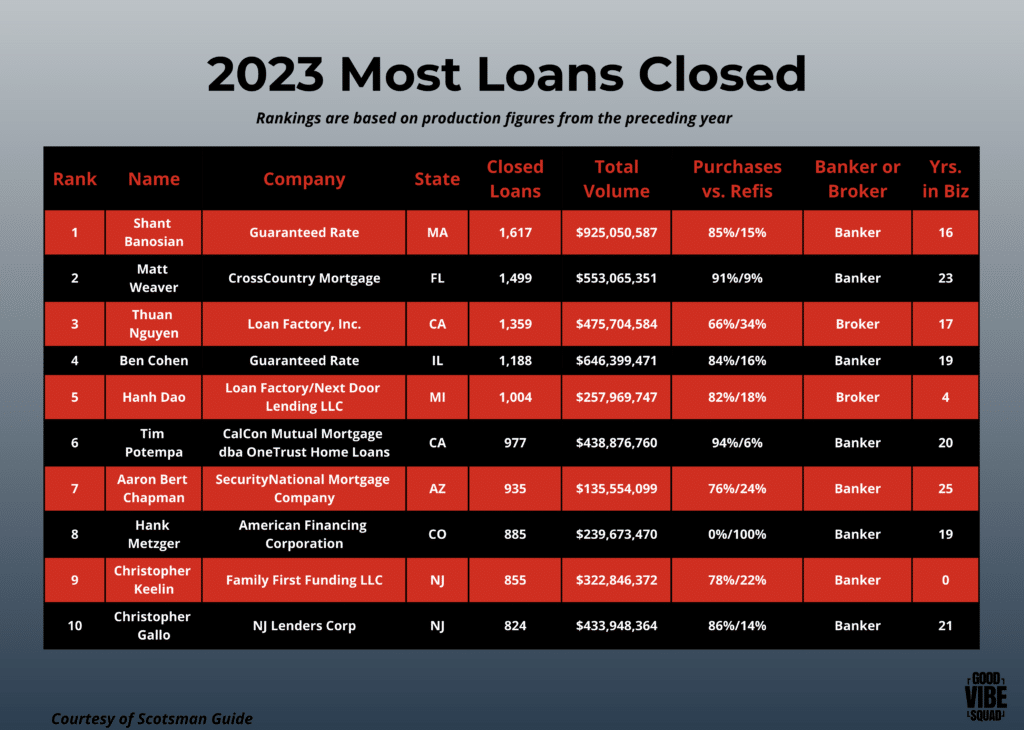

6. Stay Up to Date with Industry Trends and Data Through the Scotsman Guide

The Scotsman Guide 2023 Top Originators Rankings is an annual ranking that recognizes the nation’s top loan originators. This distinguished ranking is highly acknowledged in the industry and serves as a standard for mortgage lending excellence.

Loan originators must exhibit extraordinary performance and competence in their area to be included on this exclusive list. The rankings are determined by a number of factors, including total loan volume, loan closings, and customer satisfaction ratings. Only those who consistently generate extraordinary outcomes and give exceptional service to their clients are eligible for a spot on this exclusive list.

The Scotsman Guide 2023 Top Originators Rankings not only recognizes individual achievement but also emphasizes the value of professionalism and competence in the mortgage sector. It is a testimonial to the hard work, dedication, and devotion of these top originators who go above and beyond to assist individuals in realizing their homeownership ambitions.

This ranking inspires and motivates prospective loan originators to strive for greatness in their jobs. It establishes a high level of professionalism and pushes people to constantly enhance their skills and knowledge in order to better serve their clients.

7. Join a Facebook Group

- The MLO network is a gathering place for like-minded loan officers to discuss marketing, loan structure, and persuasion.

- Questions and Ideas for New Loan Officers to Succeed in the Mortgage Industry.

Real Estate Agent & Loan Officer – Referrals, Leads, & Networking

- This group connects Real Estate Agents and Loan Officers to improve referrals and leads while also providing amazing marketing ideas and suggestions to help your firm thrive.

- LOS is a place where Loan Officers can get LIVE SUPPORT

Mortgage Professionals Network

- This forum is for professionals in the mortgage sector to share ideas, opportunities, and insights about the industry.

8. Listen to a New Podcast

Looking for a new podcast? “The Lendsetter Show” drops new episodes weekly on Mondays offering key insights from real experts on lending, real estate, and business subjects.

Preston Schmidli doesn’t simply talk about theory; he gives listeners practical tips and techniques they can use right away. As a result, “The Lendsetter Show” is not only informative but also extremely beneficial for anyone seeking to make sound business decisions.

With heavy hitters like Barry Habib and Hammer Helmer, and real Good Vibe Squad members crushing it in the current market, this is a show you won’t want to miss.

The Lendsetter Show

Real conversations, Real experts.

Where personal growth meets professional growth and RESULTS.

9. Mortgage Coaching Programs

Mortgage coaching programs offer hands on learning in sales, marketing, and leadership. Whether you are looking for one-on-one coaching or coaching in a group setting, you can find a coaching program best suited for your needs.

Mortgage Champions by Dale Vermillion

- Dale Vermillion, a top mortgage industry trainer, speaker, and consultant, developed Mortgage Champions. Dale and his company have trained over 1 million loan originators and advised over 600 companies over 25 years. Mortgage Champions presently offers three separate training packages to meet the demands of teams of all sizes.

CORE Training by Rick Ruby

- CORE Training was formed in 2001 by Rick Ruby, Reeta Casey, and Todd Scrima. Since then, their program has grown to become one of the most popular loan originator training programs. The program’s primary goal is to hold mortgage professionals accountable by providing them with a plan, accountability partner, active community, and competitive atmosphere.

High Trust Coaching with Todd Duncan

- Todd Duncan, an award-winning trainer and consultant with nearly three decades of mortgage industry experience launched High Trust Coaching. He is also the author of the New York Times best-selling book High Trust Selling: How to Make More Money in Less Time and with Less Stress. There are three levels of coaching available: Producer Level Coaching, Master Level Coaching, and Elite Level Coaching.

Building Champions with Daniel Harkavy

- Building Champions coaching places a strong emphasis on leadership development and mentorship. The case studies are largely about assisting businesses in establishing high-performing teams, strengthening their cultures, and overcoming specific enterprise-level difficulties. The coaching offers a large roster of executive-level mentors and coaches with distinct skills, and you are free to choose any coach to handle your company’s specific needs from crisis management and professional growth to effective communication and purpose development. Building Champions now offers six different coaching options.

Performance Experts with Tim Braheem

- Tim Braheem started in the mortgage industry in 1992 and has been named multiple times as one of the top fifty loan originators in the United States. Performance Experts, his coaching firm, provides coaching programs for both loan originators and team leaders.

20/20 Vision For Success with Christine Beckwith

- Christine Beckwith is an award-winning coach who has a lengthy history of success in the mortgage sector as a top-performing loan officer as well as an experienced executive manager of a national fintech platform. She has a plethora of practical knowledge on a wide range of topics, including mortgage marketing and the future of disruptive technology in this business. Christine’s company, 20/20 Vision for Success Coaching, provides sales-accelerating coaching sessions to participants in order to assist them establish successful strategies for higher sales, extended networking, and greater execution. Vision for Success now offers three unique coaching programs.

Mortgage Marketing Coach with Doren Aldana

- Doren Aldana is the founder and chief coach of Mortgage Marketing Coach, a tailored mentor-style coaching program designed to assist mortgage professionals close more deals regardless of market conditions. Doren’s curriculum is distinguished from many others by its emphasis on marketing strategies and quantitative outcomes.

AMPLIFII by Rene Rodriguez

- Rene Rodriguez is a world-class sales strategist and keynote speaker who has advised senior teams at Coca-Cola, Microsoft, and Bank of America. He’s also been included on the 40 under 40 list for seven years. Rene and his organization, Volentum, have taught over 100,000 people in behavioral psychology to solve some of the most difficult challenges in leadership, sales, and transformation throughout the years.

Personal Coaching with Dan Trinidad

- Dan Trinidad is a 30-year mortgage industry veteran and the CEO of Partners Mortgage. Dan reveals how he has conquered adversity and launched multiple successful enterprises in the highly competitive mortgage market.

XINNIX System with Casey Cunningham

- Casey Cunningham is a successful 30-year veteran in retail mortgage banking. Casey has served as Executive Vice President of a $4 billion mortgage company, was named one of Atlanta Woman Magazine’s Top Female Entrepreneurs, and has received yearly accolades from the National Association of Women in Real Estate Business. She is also a national keynote speaker and the founder of XINNIX, one of America’s most prestigious mortgage sales and leadership training academies.

Millennial Mortgage Marketing Training with McBilly Sy

- Mcbilly Sy, the co-founder of Good Vibe Squad, is an award-winning marketer and mortgage coach. Recognizing the need for a community that promotes self-improvement and supports one another’s ambitions, he co-founded Good Vibe Squad along with Preston Schmidli. His YouTube channel is regularly updated with sales and marketing training to help LOs stay on top of industry trends and keep growing.

Mortgage Marketing Training

10. Invest in the Right Mortgage Marketing Agency

Good Vibe Squad is an award-winning marketing agency that offers access to unparalleled performance coaching, lead gen, and community. See how hundreds of loan originators and brokers all over the country have taken their productions and careers to new heights with a proven system that doesn’t revolve around asking realtors for business.

Good Vibe Squad generates quality leads and integrates them into their Hybrid Automation system to automate your sales process while nurturing those leads to fill your schedule with appointments, applications, and pre-approved buyers.

Good Vibe Squad Marketing also offers comprehensive education and high-performance live coaching on sales training, systems training, and high converting phone scripts with actual sales call recordings.

See why they are the premier mortgage loan originator growth partner.

![Maximize PROFITS (STOP LOSING MONEY When You Advertise or Buy Leads) [Leaked training]](https://img.youtube.com/vi/Hls_I0CvgxE/maxresdefault.jpg)