Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

In 2023, loan officer ranked as the #13 best business job and #73 best job in America according to the US News & Global Report. The job comes with its perks, but burnout can also be an issue. So how do you know if this is the right career path for you? Being a loan officer is worth it if you’re willing to invest time in your personal and professional growth to advance your career and create the job satisfaction and work/life balance you need.

Key Takeaways

- Choosing to become a loan officer and loan originator is worth it depending on an individual’s skills, interests, work style, and goals.

- It’s important to carefully consider the financial potential, market conditions, required qualifications, and your personal preferences before pursuing a career as a loan originator.

- While loan origination can provide financial rewards, job satisfaction may vary depending on individual preferences and goals.

- The demand for loan officers tends to remain steady, regardless of economic conditions. People will always need a shelter and a roof over their head, which offers a sense of job stability.

What Are a Loan Officer’s Duties?

Loan officers are tasked with taking and processing loan applications, but they’re typically not able to process the loan itself. Common tasks include making phone calls, sending emails, and taking borrower information. Good communication and relationship-building skills are paramount to getting the job done.

What Are a Mortgage Loan Originator’s Duties?

The duties of a mortgage loan originator are similar to those of a loan officer, though a tad more extensive. A typical day involves meeting with borrowers to figure out their financial goals and help them secure a mortgage to achieve their dream of home ownership. Each day, you’ll form relationships with borrowers, review their finances, take applications, and keep track of their overall progress. The job requires you to be detail-oriented, stay current on market trends, and understand the ins and outs of financing.

Sometimes, borrowers might not be in a position to get approved for a mortgage. In this case, they’ll need help with credit repair and formulating a financial plan to achieve their goals. Remember: Just because a borrower doesn’t get approved right away doesn’t mean you’ve lost them as a client. By acknowledging how hard the homebuying process can be and by setting them up for success, these borrowers will be more likely to use your services in the future when they are ready.

Liaising with institutions and clients about the terms and conditions of loans is another big part of the job. Although working as an independent contractor is an option, loan originators can also be hired by financial organizations including credit unions, banks, and mortgage companies. Depending on your state statues, you might be able to work from home, but occasional travel may be necessary to accommodate clients and referral partners.

What’s the Difference between a Loan Originator and Loan Officer?

The titles “Mortgage Loan Originator” and “Mortgage Loan Officer” are often used interchangeably, but their core responsibilities can vary. Traditionally, loan originators go through additional education and training. They can also see through more parts of the process concerning the loan. Because their duties are more expansive, loan originators typically make more than loan officers do.

Another key difference revolves around background checks. While not all loan officer positions require a background check, all loan originators must complete a background check as part of the licensing process.

How to Become a Loan Officer

Loan officers are not required to complete any particular licensing requirements. Oftentimes, a high school diploma or GED will suffice. That said, many still choose to obtain a bachelor’s degree related to business or accounting in order to open the doors to more opportunities.

How to Become a Loan Originator

To become a Loan Originator, traditionally you must complete these five steps.

Step 1: Obtain a Bachelor’s Degree

A bachelor’s degree may open up more work options even if it is not a mandatory requirement for all loan originators. Math and accounting classes can be especially useful, and you might consider programs in business, finance, economics, or even psychology.

Step 2: Obtain Your License

To practice and stay compliant, licensure is necessary. Some employers offer test preparation help or even pay for individuals to take the licensure exam. The SAFE exam is overseen by the Nationwide Mortgage Licensing System and Registry (NMLS) and is notoriously difficult. (Read about one of our team members passing the exam on her first try!)

Leading up to the exam, there are certain requirements regarding pre-licensure education on ethics, federal rules, nontraditional mortgage lending, and mortgage origination, in accordance with the Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (SAFE Act). In addition to overseeing the exam, NMLS must authorize all courses. The required number of course hours is set by each state. Although the majority of states demand 20 hours, some, like Nevada, North Carolina, Ohio, and West Virginia, demand even more.

Most states also require that applicants for licensure have a licensed banker, consumer finance company, or mortgage broker as their sponsor. Sponsorship is expected either before testing or shortly thereafter.

Step 3: Stay on Top of Continuing Education

Loan originators must undergo a minimum of 8 hours of NMLS-approved education each year to maintain their licenses, and certain jurisdictions impose higher requirements. People who are unable to finish their compulsory continuing education requirements on time might be able to enroll in late courses (but you shouldn’t count on this).

Step 4: Consider Certification

Loan originators are not required to be certified, but this can be a way to differentiate yourself in a tougher market. The Mortgage Bankers Association offers voluntary certification. Accredited Mortgage Professional (AMP), Commercial Certified Mortgage Servicer (CMS), Residential Certified Mortgage Servicer (CMS), Certified Residential Underwriter (CU), and Certified Mortgage Banker (CMB) are among some of the certificates that are now offered.

Step 5: Consider Professional Membership

Aspiring loan originators may think about joining a trade association like the Mortgage Bankers Association after getting licensed. Members of these associations often receive access to special events relating to their sector, networking opportunities, professional development programs, continuing education, and other resources for career growth and progress.

Home Loan Officer Salary

According to ZipRecruiter, as of Jun 20, 2023, the average annual pay for a Mortgage Loan Officer in the United States is $71,363 a year. Mortgage Loan Officer salaries presently range from $36,000 to $100,000, with top earners earning $120,000 per year in the United States. The average salary range for a Mortgage Loan Officer is $64,000, indicating that there may be multiple opportunities for growth and increased pay based on skill level, location, and years of experience.

Listed below are the annual mean salaries in each state in the United States taken from the Bureau of Labor Statistics as of May 2022.

| State | Annual Mean Salaries (USD) |

|---|---|

| Alabama | $72,380 |

| Alaska | $75,770 |

| Arizona | $70,170 |

| Arkansas | $76,150 |

| California | $84,250 |

| Colorado | $88,100 |

| Connecticut | $77,520 |

| Delaware | $83,900 |

| District of Columbia | $14,1180 |

| Florida | $71,790 |

| Georgia | $117,460 |

| Guam | $54,890 |

| Hawaii | $92,300 |

| Idaho | $67,670 |

| Illinois | $87,460 |

| Indiana | $84,210 |

| Iowa | $85,410 |

| Kansas | $85,660 |

| Kentucky | $73,390 |

| Louisiana | $69,770 |

| Maine | $93,460 |

| Maryland | $92,760 |

| Massachusetts | $93,570 |

| Michigan | $111,070 |

| Minnesota | $91,720 |

| Mississippi | $61,370 |

| Missouri | $84,190 |

| Montana | $77,430 |

| Nebraska | $86,750 |

| Nevada | $101,470 |

| New Hampshire | $94,330 |

| New Jersey | $89,190 |

| New Mexico | $66,470 |

| New York | $104,850 |

| North Carolina | $84,550 |

| North Dakota | $81,910 |

| Ohio | $74,560 |

| Oklahoma | $74,660 |

| Oregon | $94,510 |

| Pennsylvania | $81,240 |

| Puerto Rico | $38,470 |

| Rhode Island | - |

| South Carolina | $71,830 |

| South Dakota | $78,580 |

| Tennessee | $78,060 |

| Texas | $77,140 |

| Utah | $66,490 |

| Vermont | $78,800 |

| Virginia | $94,680 |

| Washington | $84,270 |

| West Virginia | $62,250 |

| Wisconsin | $83,970 |

| Wyoming | $73,220 |

Note: Actual compensation may vary based on experience and market conditions.

Here is an interactive heatmap of Loan Officer salaries across the United States courtesy of Zippia. The highest-paying jobs are highlighted in darker regions across the 50 states.

Source: Zippia.com

Loan Originator Salary

According to ZipRecruiter, the average annual salary for a Loan Originator in the United States in 2023 is $94,010. Salary can vary significantly depending on schooling, credentials, and the length of time you’ve been working in a given field. As you gain experience and advance your career with additional education, your earning potential as a mortgage loan originator may rise. In a career that pays commission, you can also boost the number of home loans you originate by marketing yourself and getting referrals from existing customers.

Yearly average base income as a full-time Mortgage Loan Originator will vary depending on the state in which you work. The cost of living in your state and the demand for MLOs in your region are two factors that can have an additional impact on your pay.

Listed below are the annual mean salaries in each state in the United States provided by Salary.com as of May 25, 2023.

| State | Annual Mean Salaries (USD) |

|---|---|

| Alabama | $89,064 |

| Alaska | $105,767 |

| Arizona | $94,948 |

| Arkansas | $88,346 |

| California | $106,931 |

| Colorado | $97,944 |

| Connecticut | $104,488 |

| Delaware | $99,030 |

| District of Columbia | $107,920 |

| Florida | $92,098 |

| Georgia | $94,069 |

| Guam | - |

| Hawaii | $101,715 |

| Idaho | $90,010 |

| Illinois | $99,611 |

| Indiana | $94,541 |

| Iowa | $92,777 |

| Kansas | $92,311 |

| Kentucky | $91,226 |

| Louisiana | $92,176 |

| Maine | $93,455 |

| Maryland | $99,956 |

| Massachusetts | $105,506 |

| Michigan | $96,148 |

| Minnesota | $99,350 |

| Mississippi | $86,456 |

| Missouri | $92,374 |

| Montana | $88,626 |

| Nebraska | $90,964 |

| Nevada | $97,992 |

| New Hampshire | $98,225 |

| New Jersey | $106,727 |

| New Mexico | $89,422 |

| New York | $103,450 |

| North Carolina | $93,068 |

| North Dakota | $93,087 |

| Ohio | $95,081 |

| Oklahoma | $89,637 |

| Oregon | $97,469 |

| Pennsylvania | $96,751 |

| Puerto Rico | - |

| Rhode Island | $101,599 |

| South Carolina | $91,527 |

| South Dakota | $85,428 |

| Tennessee | $89,122 |

| Texas | $95,297 |

| Utah | $91,731 |

| Vermont | $93,358 |

| Virginia | $93,358 |

| Washington | $104,013 |

| West Virginia | $87,297 |

| Wisconsin | $95,491 |

| Wyoming | $89,170 |

Note: Actual compensation may vary based on experience and market conditions.

Here is an interactive heatmap of Loan Originator salaries in the 50 states of the United States. The highest-paying jobs are highlighted in darker regions across the 50 states.

Source: Zippia.com

Number of LO Jobs Available

Although there are often rumors about housing bubbles and market conditions can change quickly, the future for loan officers and loan originators seems bright. According to Ziprecruiter.com, there are 11,021 available Mortgage Loan Originator jobs found in the United States as of June 2023. Additionally, the U.S. Bureau of Labor Statistics reported that employment opportunities for loan officers were expected to grow by at least one percent from 2020-2030. This will account for thousands of additional openings.

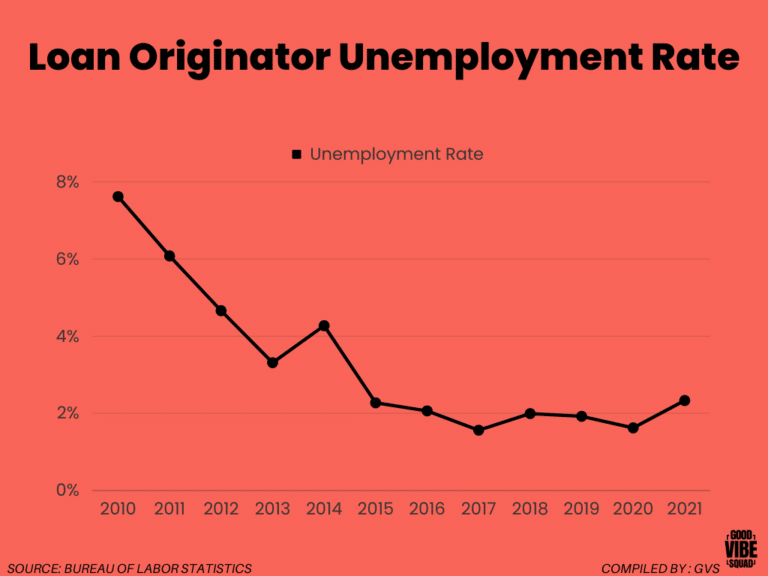

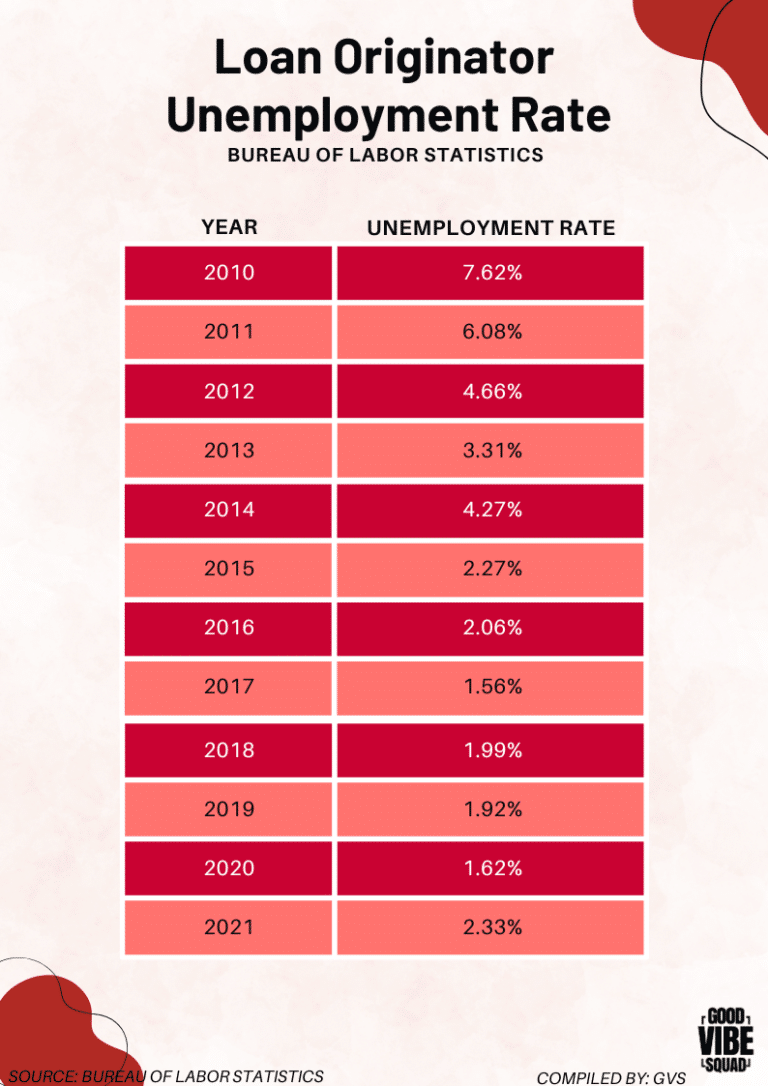

LO Unemployment Rate

According to the Bureau of Labor Statistics, the unemployment rates for loan originators and loan officers have largely fallen since 2010. Here’s how the numbers have changed over time from 2010-2021.

Home Loan Officer Job Satisfaction

Since most Americans work well into their 60s these days, it makes sense to want a career that is both rewarding and enjoyable. Many workers would be content with a job that offers low levels of stress, a good work-life balance, and reliable opportunities for advancement, promotion, and increased pay. In terms of upward mobility, the LO position is ranked as having average opportunities for growth. Stress levels and the complexities of the job can contribute to above average burnout levels. However, the position ranks as having above average opportunities for flexibility and an alternative schedule.

Finding Work/Life Balance

Finding a balance between your personal and professional lives can improve your happiness, health, and success. However, because loan officers frequently work around the schedules of their clients and referral partners, finding a decent work-life balance can be difficult. Longer hours and more stress are frequently the price of focusing on lead generation, supporting your real estate partners, closing deals, and offering excellent customer service. However, having the right tools, systems, and processes can make all the difference.

Here are some suggestions to help you optimize your working hours.

1. Prioritize daily tasks

Start the workday with a clear focus on your most important duties and finish each one before moving on to the next. You’ll feel accomplished and in control when you complete your to-do list and meet your deadlines. While some people work best in the morning, others might prefer to exercise or spend time with their families first thing in the morning. When your energy and focus are at their highest, plan your day accordingly and reserve that period of time for your most crucial obligations. Effective time management is a learned skill, but when you put effort into it, you’ll discover that you can accomplish more, put off tasks less frequently, and get back hours each week to devote to other priorities, such as your health, family, relationships, or passions.

2. Set boundaries between work and personal time

You’ll be more productive at work and achieve a better work-life balance if you establish clear boundaries between work and personal time. Nevertheless, it can be challenging to draw the line between having a life outside of the mortgage sector and being accessible to your clients when they need you. Time blocking is a great skill to learn to be more intentional with your time.

3. Delegate tasks and hire help when needed

Spending excessive amounts of time at work may be a sign of poor time management or a sign that it’s time to employ help to handle some of your workload. If possible, think about hiring help at home and at work. You can get hours back each week by delegating a few tasks each day.

4. Get ahead of stress

Finding stress-relieving hobbies that support you during difficult times is essential to maintaining balance. This can entail organizing regular vacations, scheduling brief breaks during the workday, maintaining an exercise regimen, and caring for yourself while you’re not working. Even short breaks from work can give you a physical, psychological, and mental boost.

Make it a priority to think about your self-care while you’re not working. Get frequent exercise, a balanced diet, and a decent night’s sleep. You are better able to handle the demands of the industry if you take care of your physical and mental health.

A vacation doesn’t have to be long to make a difference. Even a weekend road trip or a hike out in nature can help you reset. There will always be more work opportunities, but time with loved ones should be cherished.

5. Consider support services offered by your employer

Many mortgage firms provide their employees with programs that support a healthier work-life balance. You might be given the option of working flexible hours or on a hybrid schedule that allows you to work from home occasionally.

Additionally, many businesses these days provide Employee Assistance Programs (EAPs), which provide referrals and access to tools that can help with both personal and professional concerns. Although EAPs differ from business to business and state to state, they may offer services including financial counseling, child and elder care, therapy for addiction and depression, anxiety, and other mental health services.

Is a Mortgage Career Right for Me?

Overall, mortgage loan officer and mortgage loan originator positions can both offer a lucrative career, but every job and industry has its difficulties. These positions require substantial loan sector knowledge, great communication skills, and the ability to perform under pressure. The more time you spend practicing, the more options you’ll have to negotiate your commission, set your own hours, and grow your mortgage business. Despite market conditions, people will always need a roof over their heads and there are plenty of opportunities for MLOs in every state in the country.

Already Licensed and Ready to Help More Clients?

Join the hundreds of LOs all over the country who are leveraging our services to book more appointments, connect with more borrowers, and take their career into their own hands. Our team of specialists and our private network of mortgage professionals lift each other up and help each other conquer any market conditions.