Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Hey Mortgage Friends! It’s Jackie here, I’m one of the copywriters here at Good Vibe Squad and wanted to share some exciting news:

I JUST GOT MY MORTGAGE LICENSE!!

Woo-hoo! But wait, what exactly does that mean? Am I going to stop copywriting and start originating loans now?

Actually, no, I didn’t get licensed with the intention to originate. Instead, I am dedicating my career to helping consumers, combining my copywriting experience and mortgage industry knowledge to create resources that will educate them along their home buying journey!

But let me explain WHY I decided to make this leap…

Why I Decided To Get Licensed

After interacting with our clients over the years and listening to dozens of sales calls, I’ve learned that it’s all-too-easy to get caught up in the “expert’s curse” when talking to your borrowers.

Certain terms that seem simple to you can quickly become confusing and overwhelming to the average consumer.

I mean, just think about all the ACRONYMS swirling around in the mortgage world!

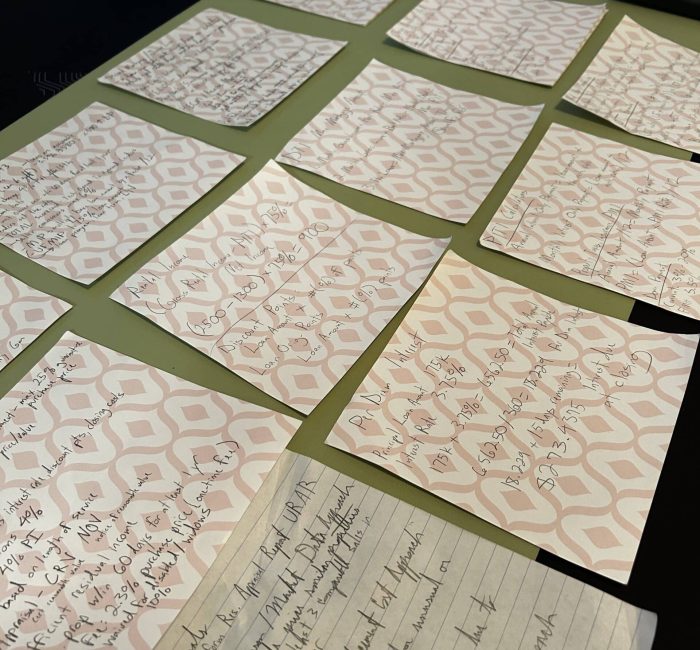

There’s PITI (now PITIA), MI or PMI or UFMIP, LTV, Housing vs Total Obligation DTI, the LE and the CD and then the finalized CD, APR and TIP just to name a few…

Plus there’s SO MUCH MORE that the average consumer needs to know before buying a home. It’s a wealth of insider information that nobody teaches in high school or even college.

Personally, I remember when I first started researching the ins-and-outs of mortgages and how it all sounded like a second language to me.

I may have a strong grasp of mortgage knowledge now that I’ve gotten my license, but to the average consumer, being bombarded with mortgage jargon can quickly become overwhelming and even stressful.

That’s why I am currently working on new resources that go in-depth into the mortgage and home buying process, taking all the complicated jargon and breaking it down into bite-sized educational nuggets that are easily digestible to the average consumer.

Super excited to leverage this knowledge in helping consumers to feel a lot less stressed – and a lot more empowered – throughout the home buying process. More to come on these new developments as we roll them out, so stay tuned!

But let’s back up for a second and talk about WHAT exactly led to that decision and HOW I actually went about getting my license…

Turning Point: What Led To This Decision?

To give you more context, I want to share with you the true, behind-the-scenes story of my experience working with Good Vibe Squad, just to show you what kind of managers McBilly and Preston are.

(Oh and if you didn’t already know, McBilly Sy and Preston Schmidli are the founders of Good Vibe Squad.)

Three months ago, back in November of 2022, we had a company-wide meeting.

At that point in time, the country was going into what looked like a recession. Both Amazon and Facebook (aka “Meta”) had each laid off over 10,000 employees.

Now that’s a scary thought, especially when you’re working with a company that exclusively serves mortgage professionals and there’s a threat of economic recession underway…

McBilly and Preston didn’t sugarcoat it. They leveled with us, explaining that now more than ever, each and every one of us at Good Vibe Squad had to show up at 100%.

So yes, they were very direct and honest with us about the realities of a recession. But it wasn’t from a place of fear. They refused to allow a threat of recession to scare them into thinking small and playing it safe.

Instead, they used the threat as fuel to become better, to raise our standards as a company.

“Good Vibe Squad is not going to shrink,” they said. “We are going to GROW in spite of the recession.”

If I were at a different company other than Good Vibe Squad, I probably would have been paralyzed with fear.

But McBilly and Preston didn’t make me feel afraid or threatened. They reminded me to never stop growing and to always challenge myself to be better.

As I stared up into my monitor, I noticed all those smiling and determined faces spread out across that Zoom meeting…

And then it hit me. Right then and there I said to myself:

“It’s time to raise your standards, Jackie.”

I decided it was time to get my mortgage license, so I could then leverage that knowledge to provide more value both to Good Vibe Squad and to our community as a whole.

By holding that company-wide meeting, McBilly and Preston had inspired me to go after that next big growth spurt.

And when I suggested to them that I get my license, McBilly and Preston did not hesitate to say “GO FOR IT!!”

Keep in mind, they knew it wouldn’t be an overnight process for me to get licensed; there’d be a good chunk of time and some costs involved to make it happen.

And yet, without question, McBilly and Preston invested all the time and resources I needed to go through the pre-licensing courses, study for the SAFE Exam, pass the test, then finish up the background checks and final steps of licensure.

They gave me everything I needed to achieve this next big growth spurt in my career.

That’s the piece that means the world to me. Working with managers who invest not just their money but also their time into my own personal and professional growth.

It means so much to me because I’ve worked with all sorts of bosses in the past, and I cannot tell you how frustrating it is being managed by a short-term thinker.

Let me explain what I mean by that:

The Short-Term Boss Vs. The Long-Term Manager

A short-term thinker is the type of boss who stares at their bottom line obsessively wondering, “How much revenue did Employee A generate from X number of hours this week?”

It’s a penny-rich, dollar-poor mentality that’s focused on short-term profits rather than long-term growth and impact. Then those bosses wonder why employees come and go through their business like a revolving door…

When your boss is a short-term thinker who fails to see the big picture, it kills your sense of purpose as an employee.

It’s a shame, really, because having a strong purpose, having a strong “WHY” behind what you do every day, that’s what gets you excited to jump out of bed every morning and give it 100% your best.

Without that strong “WHY” to fuel you, then you’re left feeling like a cog in a machine who has to hit snooze 25 times before forcing yourself to get up and go to work each morning…

Thankfully, McBilly and Preston are NOT short-term thinkers. They’re true visionaries who’ve challenged me and inspired me to give 100% my best every day.

That’s the kind of life I want to live. A life in which every day actually means something. I’m not just clocking in and exchanging time for a paycheck, I’m making a real difference and living up to my true potential.

So yes, while I am thrilled and proud of myself for having gotten my mortgage license, I feel even more grateful for what that milestone really REPRESENTS.

It represents the gift of working with a company that’s willing to invest in me. Having managers who don’t just see me as a number but instead see the long-term impact and growth potential within me.

So here’s to McBilly and Preston for challenging me, inspiring me, and giving me the opportunity to always be better.

These guys are outstanding motivators, fearless leaders, and overall just wonderful human beings. It’s an honor and a privilege to work with these two.

Much love,

Jackie