Attention loan officers! Are you looking to enhance your career opportunities with effective social media marketing in 2024? With millions of potential home buyers and borrowers browsing their social media feeds daily, having a solid online presence is now optional but necessary. However, with strict regulations to follow, managing client deals, and running a business, mastering social media can be overwhelming.

This guide presents tips and tricks from top-performing loan officers using social media to generate leads effectively. Additionally, it offers intelligent tools to help you create compelling content. Developing and implementing successful social media strategies can be achieved by using real-life examples from popular platforms such as Facebook, Instagram, LinkedIn and TikTok. You can implement these tips immediately to succeed on every central mortgage platform.

Key Takeaways

- Prioritize just 1-2 core platforms rather than spreading yourself thin trying to manage every channel.

- Outsource and delegate tasks through automation, freelancers, and helpful tools so you only spend time on critical social activities delivering ROI.

- Frame your content around serving clients’ needs and solving their pain points rather than purely promotional material.

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Key Questions All Loan Officers Have About Social Media Marketing

Behind every significant social media presence is a loan officer asking how to balance it with their regular responsibilities. Get advice from the best in the business on practical ways to incorporate social media into your weekly routine, avoid getting overwhelmed, and focus only on what will get you results.

Platforms Loan Officers Should Focus On In 2024

With new social media sites launching regularly, it’s tempting to create accounts everywhere in hopes of discovering an untapped audience. But top producers caution that scattering your efforts across too many networks can hurt more than help.

Ensuring uniformity and coherence in your brand’s social media presence across all platforms is crucial. This includes providing all information, content, and branding aligned with your marketing strategy. It’s critical to find the ones that work well for you. For instance, Instagram is an excellent choice for targeting the under-40 demographic, while Facebook is better suited for reaching a broader audience and consolidating your content.

It is essential to do more than have accounts on every social media channel. It would help if you focused on building and nurturing communities where your clients spend their time. This means finding the right mix of platforms that align with your target audience. For instance, if you want to reach real estate agents, Facebook might be your best platform. Instagram and TikTok could be more effective if you want to target younger, first-time buyers. Similarly, if you want to connect with professionals, LinkedIn might be the way to go.

Social Media Marketing on LinkedIn

LinkedIn is a social media platform that helps individuals network professionally and establish meaningful connections within their industry. It enables individuals to create a detailed profile highlighting their skills, education, and work experience.

Loan officers can benefit from LinkedIn in several ways. They can join groups relevant to their industry or interests, connect with colleagues or clients, and follow industry influencers and thought leaders. They can stay up-to-date with industry news, trends, and insights by doing so.

Additionally, loan officers can use LinkedIn to establish themselves as experts in their field. Sharing knowledge and insights establishes thought leadership and credibility with potential clients and referral sources. They can also use LinkedIn to showcase their achievements, such as awards or publications, which can further enhance their reputation.

Social Media Marketing on Facebook

Loan officers need to establish a solid online presence to stay competitive in the market. One of the most effective ways to achieve this is by creating a dedicated Facebook business page. This platform provides an excellent opportunity for loan officers to showcase their expertise, connect with their audience, and build credibility.

Loan officers can use Facebook’s business page to share informative and engaging content, including blog posts, case studies, industry news, and other relevant information. This content can help establish their thought leadership and professional credibility.

In addition, professionals can use Facebook’s paid advertising options to create highly targeted advertising campaigns. This enables businesses to customize their advertising by targeting specific demographics, geographic locations, and interests. This optimizes the effectiveness of their ads and increases visibility to their intended audience.

A Facebook business page can benefit loan officers, as they can showcase their services and expertise to potential clients. They can create educational and informative content explaining loan programs, interest rates, and the loan process. By using Facebook’s paid advertising options, they can target individuals who may be interested in their services, such as first-time homebuyers, individuals looking to refinance, or those interested in investment properties.

Social Media Marketing on Instagram

Loan Officers can use Instagram as a powerful visual social media platform to connect with a visually-inclined audience and promote their services. By leveraging Instagram’s powerful features, loan officers can share informative posts and stories that can provide valuable information to their target audience and enhance their brand. This can help loan officers connect with their audience and expand their reach.

Loan officers can also use Instagram to promote services and establish relationships with potential clients. They can create detailed posts and stories that educate people about the various loan options, helping them make informed decisions. Additionally, loan officers can use Instagram to showcase their expertise and build their brand in the industry. Loan officers can establish themselves as experts in their field and gain followers by sharing their knowledge and experience on the platform.

Social Media Marketing on YouTube

Loan officers have an excellent opportunity to use YouTube as a powerful tool to educate their target audience and provide valuable advice on industry-related topics. They can create informative videos to showcase their knowledge and expertise, which can help them establish themselves as thought leaders and experts in their field. This platform provides an excellent opportunity for professionals to share their insights and expertise with a broader audience and increase their credibility and trust with their target market.

Loan officers can educate their audience on various industry-related topics through informative videos. They can advise on loan application requirements, credit scores, loan refinancing, and other relevant issues. They can help their audience make informed decisions about their financial future by sharing their knowledge and expertise.

Furthermore, by establishing themselves as thought leaders and experts in their field, loan officers can gain a competitive advantage over their peers. Building trust and establishing credibility with prospective clients can significantly boost business growth. It is essential to focus on these factors to attract more customers and retain existing ones. Loan officers can expand their reach and connect with potential clients through YouTube.

Social Media Marketing on TikTok

TikTok is a popular social media platform, particularly among younger audiences who prefer viewing short-form videos. The platform currently boasts more than 800 million active users worldwide. On TikTok, users can produce and distribute brief video clips that can last anywhere from 15 seconds to one minute.

This platform is an excellent tool for loan officers to create interactive content that educates potential clients about various topics. The videos created can be engaging, informative, and entertaining, making it easier for the audience to stay connected and interested in the content. Furthermore, TikTok’s algorithm is designed to promote trending topics, making it easier for content creators to reach a broader audience.

Loan officers looking to expand their reach and connect with potential customers could benefit significantly from leveraging TikTok. They can create videos that educate the audience about various loan products, provide tips on improving credit scores, and promote financial literacy. Loan officers can establish expertise and trust with potential clients.

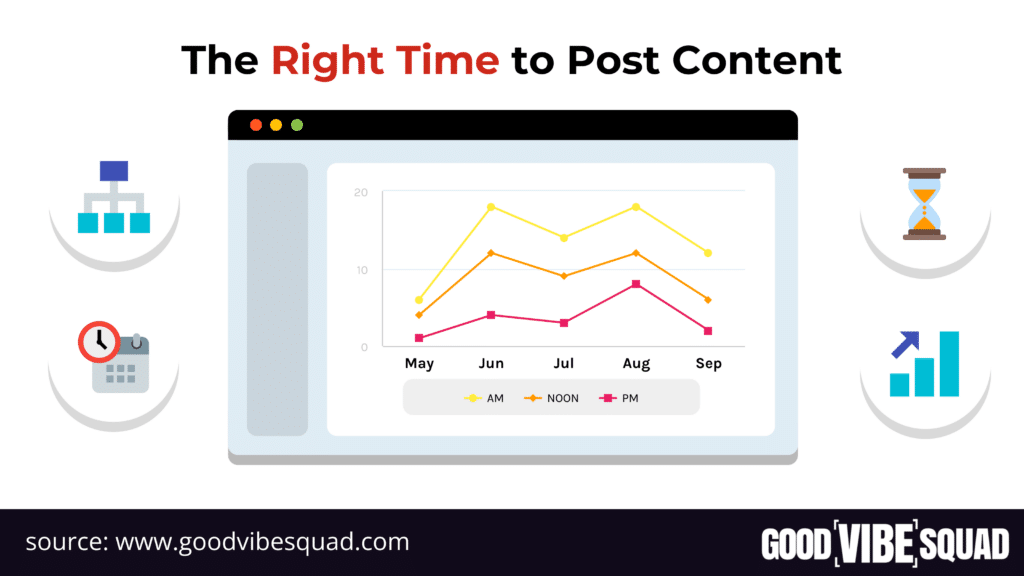

The Right Time to Post Content

The beauty of social media is the flexibility – you can share videos at 7 am or lessons before bedtime and still see great results. But staying consistent with when you post helps signal your audience when to check for updates.

Posting between 8 am and 9 am, when people are commuting, enjoying their coffee, and checking their phones, is the best time to reach out to your followers.

For specific platforms, use built-in analytics to see when your audience is online and experiment to determine what timings get you the most likes, comments, and shares for your mortgage niche. Knowing if your clients scroll during their lunch breaks or watching TV after dinner can clue you into the prime times to reach them.

How To Manage Social Media With a Busy Schedule

Finding time is the hardest part. But there are intelligent shortcuts top-performing loan officers have perfected that can radically simplify social media, even if you only have 1 spare hour per week.

Here’s an efficient system for outsourcing tasks through Upwork or Fiverr to give you back time:

- Share your knowledge and expertise

- Position yourself as an authority

- Hire freelancers to edit videos or create graphics

- Schedule posts in advance for consistent publishing

- Involve family members to assist with administrative tasks

Delegating tasks as much as possible using tools and people is recommended. Building a process that plays to your strengths while utilizing technology and empowering labor to help with the rest is essential.

For instance, if you are a producing loan officer, it is best to avoid taking on a full-time marketing job on top of your regular responsibilities. Instead, focus on what you can uniquely offer through social platforms, such as expertise, personal advice, and helpful mortgage content.

Key Social Media Marketing Strategies to Attract More Loan Clients

Now that the big questions are covered, let’s explore the proven loan officer social media tactics for every central platform – from ideal content formats to posts that convert followers into clients. Take what works for your mortgage business and make it your own.

Facebook and Instagram Social Media Marketing Tips

We’re combining Facebook and Instagram strategies because their highly visual formats and active Stories features make them ideal for showcasing your mortgage knowledge while connecting personally.

Here are some ideas for creating content that will be effective:

- Behind-the-scenes office glimpses

- Relatable family, hobby, or community photos

- Client success stories and testimonials

- Educational videos up to 1 minute long-

- Instagram Reels and trending TikTok formats

- Homebuyer Tips and Loan Process Q&As

Here are some captivating post ideas that will be useful:

“We recently helped the Smith family pictured here move from their apartment into their first home. As their loan officer, I guided them through every step of achieving this dream.”

“Have questions on what paperwork you’ll need when applying for a mortgage? I’ll walk you through the six key documents no first-time homebuyer should be without.”

“Morning walk with Luna before heading to back-to-back client meetings today. Drop any mortgage questions below!”

Facebook and Instagram emphasize personality and community, so spotlight your expertise while showcasing your human side with a peek behind the scenes. Let followers get to know the real you and the people you help through posts that balance industry knowledge with fun personal details. This familiarity builds trust and relationships that convert when mortgage needs arise.

LinkedIn Lead Generation Strategies

With over 200 million members, LinkedIn is every loan officer’s key to positioning yourself professionally while networking directly with prospects.

If you’re looking to create compelling content, here are some ideas to consider:

- Educational industry articles establishing creds

- Infographics with statistics visualizing data

- Client success stories as social proof

- Collaborations with real estate partners

- Discussions and polls to encourage comments

- Local market updates and personalized advice

Here are some exciting post ideas that could be helpful:

“Thinking of investing in rental property? Here are five key financial factors investors should consider first with helpful calculators.”

“Excited to be headlining an upcoming seminar on accessing home equity with featured guest Taylor Smith, the top Bay Area realtor. Registration links in comments!”

“Home prices in Phoenix have jumped 12% since last year, according to the latest Case-Shiller index. Current homeowners have seen values rise, while buyers face increased competition…”

The professional demographic on LinkedIn makes it ideal for displaying your mortgage qualifications through content like statistics, data visualizations, credentials, and connections with industry partners. Combine sharing your expertise with starting meaningful discussions to bring followers into the conversation.

YouTube Channel Tips for Loan Officers

YouTube offers loan officers complete versatility with content formats, from quick explainers to serialized video courses. The key is consistency.

If your goal is to produce exciting and captivating content, there are several concepts you may want to contemplate:

- Video series tackling loan questions

- Live Q&As for real-time advice

- Video responses to specific follower asks

- Guest collaborations with real estate agents

- Behind-the-scenes video office tours

- Relatable day-in-the-life video diaries

Here are some suggestions for exciting post ideas that could be valuable:

“I’m excited to launch my new First Time Homebuyer YouTube series, answering the top questions I get weekly from clients on the buying process, credit scores, mortgages, and more. What do you want to see in Chapter 1? Comment below!”

The visual nature of YouTube gives you creative freedom – inform through detailed video tutorials while showcasing genuine interactions with clients and partners. Use playlists and series to feature multiple videos around popular mortgage topics. This establishes continuity, keeping viewers returning while positioning your expertise around common pain points.

Emerging Opportunities on TikTok & Instagram Reels

TikTok and Instagram Reels demonstrate massive potential for loan officers to engage new audiences with quick video content.

If you want to create engaging content, consider these concepts:

- Industry news explained through graphics

- Common mortgage myth debunking

- Client testimonials and reactions

- Office moments and work/life balance

- 30 second homebuyer & financing tips

- Interactive polls, prompts, and questions

Here are some tips for exciting post ideas that could be practical:

“Thinking of dipping into your home equity? Here are three smart ways to leverage the equity you’ve built for [insert goal here] without losing your home. Have questions? Ask below! #mortgagetips #homeequity #realestate”

The short video formats on TikTok and Instagram Reels let you deliver bite-sized mortgage advice between the funny dance trends. Think quickly, explaining graphics, client interactions, and news delivered through creative templates. Use prompts and questions to encourage engagement. Once you build audience familiarity, introduce promotional offers or lead magnets to incentivize potential clients.

Trends will come and go, but the social media fundamentals stay the same – provide value consistently, showcase expertise, and forge authentic connections. Now, put these mortgage social media tips into action and watch as more prospects discover and choose to work with you in 2024!

A Strategic Social Media Framework for Consistent Client Engagement and Business Growth

Balancing industry regulations, an overflowing pipeline, and running every aspect of your loan business is demanding enough. Finding the time and energy to master social media on top feels impossible some weeks.

As a loan officer, stick to this social media framework by playing to your strengths while outsourcing the rest. Stay focused on consistency over quantity of networks. Above all, ensure your content squares up to client problems rather than product pitches.

Do this, and you’ll build social authority plus an audience of prospects ready to work with you.

5 Frequently Asked Social Media Questions Loan Officers Have

Q: How can I make compliant social media posts?

A: The first step is reviewing your company’s social media policies and mandated disclosures around lending laws. Typical requirements include listing license numbers, avoiding misleading claims, and protecting client privacy by not sharing details without consent.

Q: What types of content best connect with potential borrowers?

A: Loan clients care most about solving their problems and achieving their homeownership dreams. So, take an educational approach focused on breaking down the terminology, explaining the documentation needed to apply, detailing different loan programs, or clarifying financing steps. This positioned you as an informative expert versus a salesperson. Also, mix in some behind-the-scenes peeks at you helping buyers one-on-one for touchpoints of relatability. Sprinkle in market updates, Invite client questions, and start discussions to encourage community.

Q: How do I make my social media efforts measurable?

A: All platforms provide free analytics on followers, post reach, engagement rates, clicks, and more. However, many third-party tools like Iconosquare or Hootsuite give even deeper analytical capabilities to gauge behavior and optimize efforts. Set benchmarks for growth monthly and track progress on key metrics like lead capture form conversions, phone/email clickthroughs, followers earned, shares, or website visitors from links posted. Establish what success looks like in numbers for each network.

Q: Should I consider paid social advertising?

A: Once you build engagement organically, paid boosting through platform tools can amplify your best-performing evergreen content beyond just followers. Thoughtfully targeted ads to ideal buyer demographics in your area also attract qualified prospects already interested in financing based on browsing history and online behaviors. Start small with $25 per week testing different types of creatives – from educational videos to client testimonial images to event promotions. Measure conversions on calls, form fills, and emails generated and scale up accordingly on what content resonates best with cold audiences.

Q: How do I make posts stand out from the endless feeds?

A: Cutting through the noise starts with understanding your specific audience’s pain points and creating content that resonates by addressing those needs. Use attention-grabbing hooks upfront through bold stats, thought-provoking questions, or unique perspectives. Visually captivate with photos, video clips, or graphics. Craft shareworthy posts with actionable advice tailored to each platform’s format strengths. And focus on serving first with value before ever pitching services. This quality-over-quantity approach produces posts that viewers take note of.

Unlock Your Mortgage Business’s Potential with Good Vibe Squad: Elevate Your Marketing Game Today!

Are you looking to transform and expand your mortgage business? Look no further than Good Vibe Squad – your trusted mortgage marketing partner. Our team specializes in developing tailored, outcome-driven strategies to help you stand out in the competitive mortgage market. Having a demonstrated history of assisting clients in prospering, we’re here to assist you in generating more leads, closing more deals, and boosting your ROI.

Take advantage of the opportunity to intensify your mortgage marketing efforts. Join the Good Vibe Squad today and ride the wave of success in the mortgage industry. Get in touch with us today to embark on your journey towards excellence. We’ll help you achieve your goals and reach new heights in the industry!