Leads are absolutely vital to businesses today, and this is especially true if you are a new or small business looking to make a name for yourself. Leads provide companies with the clients and customer base they need to survive in the market. Lead sources are the main way companies gain these clients and interact with their customers. So, you must build these strong and understand the data sets they provide to have long-term success in your mortgage loan industry.

Let’s take a closer look at lead sources and their importance before diving into explanations of data sets and how you can best use them.

Key Takeaways

- Leads are crucial for businesses, especially for new and small ones looking to establish themselves in the market.

- Measuring lead sources is important to identify what works and what doesn’t, and the data sets can tell you which channels are most effective, which marketing efforts turn audiences into sales leads, which keywords and selling points generate the most leads, and how people prefer to reach out to you.

- Using a CRM software and tracking and analyzing your lead sources regularly can help you identify which ones are generating the best quality leads and adjust or eliminate those that aren’t.

- Monitoring and analyzing your lead source data regularly is essential to ensuring your marketing efforts are effectively generating quality leads.

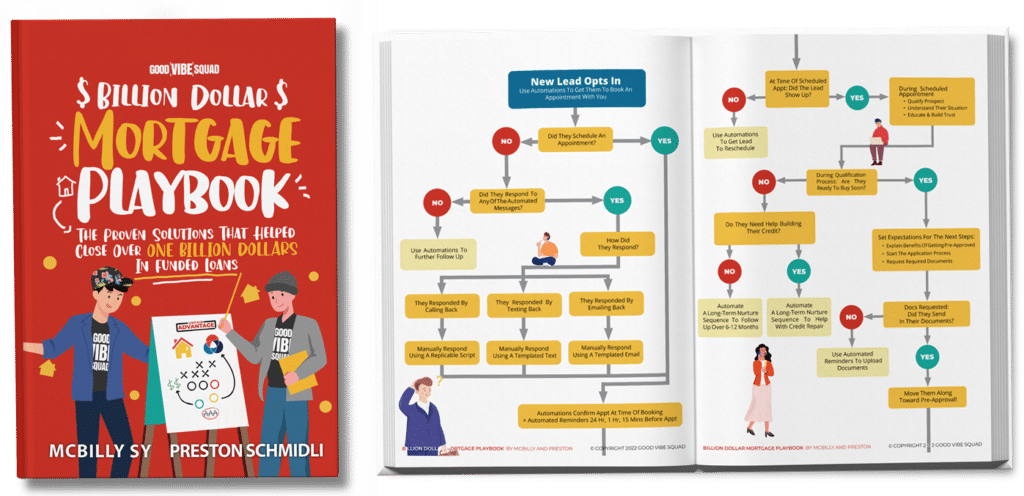

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

What are lead sources?

Simply enough, a lead source is a source by which a lead originally finds your website. It is the marketing channel that first pushes leads and potential customers to your business and helps you take those first steps in building a working relationship.

How does a lead source work?

A lead source takes a lead directly through to your business, whether it be your website, an email address, or a phone listing. To get a better understanding, let’s look at an example. You have created a social media post with educational information for new homebuyers on credit repair. Some of your previous clients have shared the post with family members they think could benefit. When the family member clicks on the shared post, it takes them directly to your website blog. In this case, the lead source would be your social media post as well as your blog post as they were what ultimately brought in a new lead.

Types of lead sources

When it comes to lead sources, the possibilities are endless, and they are not always limited to digital marketing strategies. Here is a list of common and effective lead sources.

- Blog posts with SEO optimization

- SEO-optimized landing pages

- Organic searches and organic traffic from search engines

- Guest posts published on sites other than your own website, such as industry sites

- Pay-per-click ads on both search engines and social media platforms

- Social media profiles and posts

- Webinars

- Email marketing

- Backlinks from partner websites

- Referrals

- Direct mail marketing

- Billboards

- Tradeshows and networking events

- Business cards

- QR codes

While traditional advertising with non-digital marketing lead sources can be more difficult to track results, it is possible. For example, you can create independent landing pages specific to each offline marketing option to see which source provides effective lead-generation efforts. This works for business cards, direct mail marketing, and QR codes. You can even consider establishing a specific phone number and line that tracks calls from direct mail marketing, such as business cards and flyers.

Importance of measuring your lead sources

Lead sources are vital to your business because they provide the essential original connection between your business and clients. However, if you don’t measure your leads effectively, you’ll likely waste your marketing budget on methods that may not be working for you.

- Figure out what works. By measuring your lead sources, you can identify which lead-generating methods work best for your unique mortgage loan business. Doing so allows you to focus more on these channels than on those that don’t produce as much. For example, if you notice a lot of traffic and new customers from social media accounts and less from email marketing streams, you may consider putting more effort into social media and reducing your email marketing campaigns.

- Figure out what doesn’t work. If you find that specific lead source strategies are not working well, you need to decide whether to enhance and adjust a current lead source option or eliminate it and replace it with a different option.

What can your lead source data tell you?

Once you have your lead sources set up, you need to be able to translate the data sets they provide. These data sets can be lifesavers when it comes to your marketing strategy and determining whether or not your efforts are bringing in quality and valuable leads. They can tell you which marketing channels are most effective, which audiences you need to focus on targeting, which keywords and selling points win you the most contact, and how people prefer to reach out to you.

1. Which channels are the most effective at reaching your target audience?

You can use numerous channels for marketing your mortgage loan company across the web, but not all of them are built the same way. In fact, each generates very different audiences and demographics. Make sure that you pay attention to your data sets to figure out which channels connect you with your target audience the best.

2. Which marketing efforts turn audiences into sales leads?

It doesn’t matter how many people view your content if none of them respond to it and become sales leads. Data sets will let you know which of your marketing efforts is working the best to convert your leads and promote your business.

3. Which keywords offer the best lead generation?

Keywords help your content appear in audiences’ searches across Google or other platforms. Their presence will direct whether your content will be one of the top search results online. Knowing the keywords in your content that bring in the most people is key.

4. Which selling points get results?

The best way to market your mortgage loans is in a way people respond to, and the best way to know how people will respond to your message is by using a few different selling points to see which works best. If you consistently use one method, you may not know that another will work better. Mix it up a bit and let your lead data show you how to sell the most product.

5. How people reach out to you

Knowing how your customers like to stay in touch with you is key to having successful customer service in your mortgage loan business. You need to answer questions, respond to comments, and keep in touch with your customers. Data sets from lead sources can let you know which streams will be most effective for your communication needs.

What should you do with the data?

Once you have gathered lead source data, you are able to analyze the results and see which lead source efforts are proving effective at generating leads and which require adjustments or removal from your marketing strategy. Here we look at this process closer in order to gain a better understanding.

1. Use a CRM software

Implementing a quality CRM, or customer relationship management platform can help you automatically analyze data information from your various lead sources. This can help provide you with a clearer picture of all your different lead sources and which ones are working, all with the simple touch of a button. In addition, a quality CRM can provide automation for many of your lead tracking and analysis needs.

2. Identifying and tracking lead sources

Whether through your CRM or another tracking tool, it is important to identify, evaluate, and track all your active lead sources. For example, if you are looking at email marketing campaigns, you will want to identify each specific campaign.

3. Determine which lead sources provide qualified leads

Once you determine all your current lead sources, you want to evaluate their success when it comes to lead generation and engagement with potential clients. For example, if we go back to email campaigns, you want to look at each campaign’s open rate and click-through rate. This will help you evaluate the success of a campaign and see how many leads actually connected with your website and provided a quality lead.

4. Determine which lead source converts the most

Once you have a clear picture of each of your lead sources, you can evaluate which ones are providing the best overall lead generation and which ones may not be as effective. Once you make this determination, you can adjust current lead sources or create new ones based on previously successful efforts.

5. Monitor and analyze the success

It is important to re-evaluate your lead sources on a regular basis. Analyze data at least once a month to see which efforts are proving effective and which ones may need to be put on the back burner or scraped completely.

Use lead source data to your advantage

When it comes to lead sources, your options are endless. Whether you are looking to use traditional marketing methods, such as direct mailings, or moving to a digitally based marketing strategy utilizing social media and email campaigns, tracking the efforts of all your lead sources is essential in order to ensure your marketing efforts are effectively generating quality leads. Following these tips can help ensure that you get the most out of your lead sources and generate the leads you need to boost your overall conversion rate.

Boost your lead generation today

At Good Vibe Squad, we understand the importance of quality lead generation. But we also understand how difficult this can be on a regular basis. With our Unfair Advantage™ program, we help you generate the leads you need to boost your closing rate and reach your business goals.

To learn more about how we can help, book a strategy call today.