Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Years ago, marketing focused on print and television ads. In today’s marketing world, you have print, television, YouTube, TikTok, social media platforms like Facebook and Instagram, and websites and search engines. While many businesses work to create separate marketing focuses for each of these platforms, omnichannel marketing focuses on the customer experience and unifying all your marketing efforts.

Here we take an in-depth look at omnichannel marketing and the difference it can make for your lead generation and conversion ratio.

While the content and message of your marketing efforts play a major role in your success, how you market that information can be just as important to the success of your efforts.

Key Takeaways

- Omnichannel marketing gives customers a unified experience across all marketing platforms, like print, TV, and social media.

- It differs from multichannel marketing, which uses each platform separately. Omnichannel marketing ties all platforms together for a seamless experience.

- This strategy is especially good for the mortgage industry. It gives clients a smooth process across all channels, from emails to in-person meetings.

- To do omnichannel marketing right, it’s important to understand the customer journey, keep your branding consistent, and make moving between channels easy for the client.

- Future trends in omnichannel marketing might include voice-activated assistants, chatbots, and personalized video marketing. These tools can help make customer interactions even smoother.

Omnichannel Marketing: Definition

Omnichannel marketing is used by many mortgage lead generation services and mortgage professionals and is important to delivering a seamless and integrated customer experience across multiple channels and touchpoints. It involves providing a consistent message, branding, and user experience throughout a customer’s journey, regardless of their channel or device to interact with a business. Omnichannel marketing aims to create a unified and cohesive experience that enhances customer satisfaction and engagement.

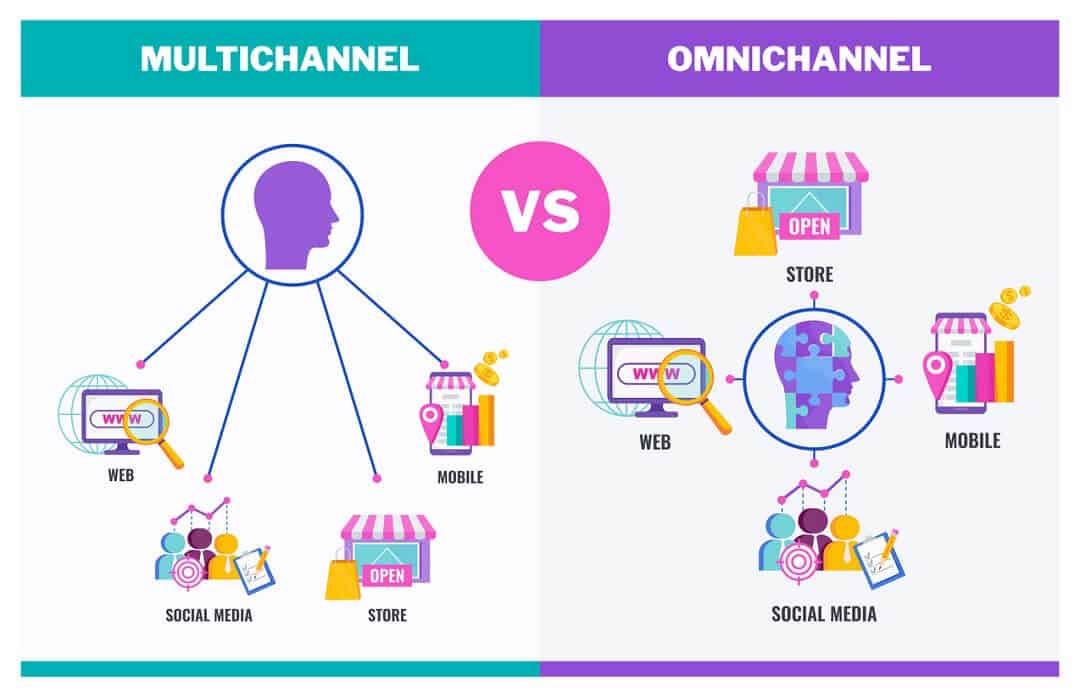

Multichannel Marketing vs. Omnichannel Marketing

Multichannel marketing utilizes various channels independently to reach a broad audience, while omnichannel marketing prioritizes creating a seamless and integrated customer experience across all channels. Omnichannel marketing places a stronger emphasis on data integration, customer-centricity, and channel orchestration to provide a unified and personalized journey for customers.

Importance of Omnichannel Marketing in the Mortgage Industry

Omnichannel marketing is particularly important in the mortgage industry due to its potential to enhance customer experience, improve lead generation and conversion rates, and build stronger relationships with borrowers.

Seamless customer experience

Buying a home and securing a mortgage is a complex process that often involves multiple touchpoints and interactions with various channels. Omnichannel marketing allows for a seamless and integrated customer experience across these channels, ensuring consistent messaging, branding, and user experience. This consistency enhances customer satisfaction and reduces friction throughout the mortgage journey.

Cohesive brand strategy and identity

Omnichannel marketing plays a crucial role in maintaining a cohesive brand strategy and identity by implementing unified messaging, visual brand consistency, seamless user experience, and coordinated marketing campaigns. This consistency builds trust, reinforces brand recognition, and enhances the overall customer experience, resulting in a stronger and more unified brand presence in the marketplace.

Adaptability to digital transformation

The mortgage industry often involves a blend of online and offline interactions. Omnichannel marketing enables the integration of both, ensuring that customers can switch between digital channels (websites, mobile apps, emails) and physical touchpoints (branches, events, phone calls) without disruption. This integration provides convenience and flexibility to borrowers while maintaining a consistent experience.

Increased engagement

Omnichannel marketing plays a significant role in increasing customer engagement. By providing a seamless and integrated experience across multiple channels, omnichannel marketing enables businesses to connect with customers in more meaningful ways.

Better conversion rates

Omnichannel marketing facilitates a cohesive and consistent customer journey, increasing the likelihood of lead conversion. Potential borrowers can seamlessly move across channels, accessing relevant information and assistance at each stage of the mortgage process. This reduces friction, builds trust, and streamlines the conversion process.

Competitive advantage

Implementing omnichannel marketing strategies can provide a competitive advantage in the mortgage industry. By delivering a seamless and integrated customer experience, mortgage professionals can differentiate themselves from competitors who may rely on fragmented or inconsistent marketing approaches. This differentiation can attract more borrowers, enhance brand reputation, and drive business growth.

Increased revenue

Omnichannel marketing, with its focus on providing a seamless and integrated customer experience across multiple channels, plays a vital role in driving increased revenue for businesses. By expanding reach, improving customer engagement, enhancing the overall customer experience, and leveraging data-driven insights, omnichannel marketing enables businesses to attract more customers, increase average transaction value, encourage repeat purchases, and foster customer loyalty, all of which contribute to a boost in revenue and long-term business growth.

Implementing Omnichannel Marketing in the Mortgage Industry

Implementing omnichannel marketing in the mortgage industry involves several key steps:

- Understand the customer journey: Begin by mapping out the customer journey and identifying the different touchpoints and channels that potential borrowers may encounter during their mortgage process. Understand how customers move between online and offline channels, such as websites, social media, email, phone calls, physical branches, and events.

- Data Integration and analysis: Establish a robust system for collecting, integrating, and analyzing customer data from various channels. This includes capturing information such as customer preferences, behaviors, interactions, and transaction history. Utilize customer relationship management (CRM) tools and analytics platforms to gain insights into customer needs and preferences.

- Channel consistency and branding: Ensure consistent branding and messaging across all channels. Develop brand guidelines that dictate visual elements, tone of voice, and key messages to be used consistently throughout the customer journey. This consistency reinforces the brand’s identity and helps customers recognize and connect with the brand at every touchpoint.

- Seamless cross-channel experience: Enable a seamless transition for customers as they move across different channels. Implement technologies and systems that allow for synchronized customer interactions, ensuring that customers can pick up where they left off regardless of the channel they are using. For example, if a customer starts a mortgage application online, they should be able to continue the process seamlessly in person or over the phone.

- Personalized messaging: Leverage customer data to deliver personalized and targeted messages, offers, and recommendations. Use segmentation and automation tools to create tailored communication based on customer preferences, needs, and lifecycle stage. Personalization enhances customer engagement and improves the chances of conversion.

- Integrated Marketing Campaigns: Develop integrated marketing campaigns that span across multiple channels. Coordinate messaging, offers, and promotions to ensure consistency and continuity. Implement cross-channel marketing automation to deliver the right message at the right time to the right audience.

- Monitor results and adjust as necessary: Continuously measure and analyze the performance of your omnichannel marketing efforts. Track key metrics such as customer engagement, conversion rates, customer lifetime value, and revenue generated from different channels. Use these insights to optimize your strategies, refine your messaging, and improve the overall customer experience.

Future Trends of Omnichannel Marketing

While marketing trends have changed from decade to decade, the use of technology and the rapid growth in many areas allows for many new marketing trends and abilities. When it comes to omnichannel marketing, some top future trends include:

- The integration of voice-activated assistants and the use of voice search

- Artificial intelligence and chatbots for real-time customer assistance

Personalized video marketing

Providing a Seamless Marketing Effort Between Channels

By aligning messaging, design, and customer experiences across various touchpoints, an omnichannel marketing approach can help businesses create a cohesive journey for customers, ensuring a seamless transition as they move between channels. This approach enhances brand recognition, fosters customer engagement, and improves overall satisfaction, ultimately increasing qualified lead generation and a higher conversion rate for your business.

Helping You Develop a Marketing Strategy That Works

At Good Vibe Squad, we understand the importance of an effective marketing strategy that delivers warm, qualified leads ready to convert. By helping you develop an omnichannel marketing strategy that enhances your brand recognition and helps build better customer relationships, we can help you generate the leads you need to achieve your business goals. To learn more about our mortgage lead generation services, schedule a call with us today.